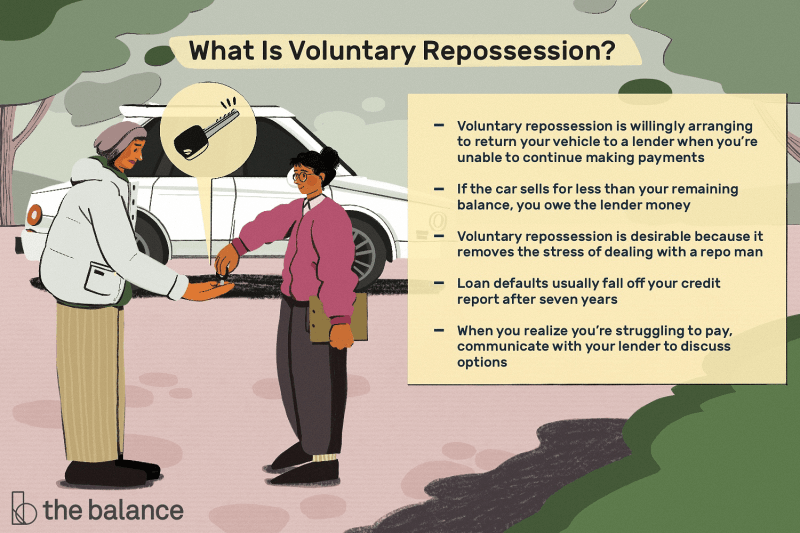

If A Car Is Repossessed Do I Still Owe – Voluntary foreclosure, also called voluntary surrender, is one of two types of foreclosures that can happen if you can’t make the payments on your own. Another is voluntary repossession, where your lender forcibly seizes your car.

You initiate a voluntary repossession by contacting the lender and returning the car. The lender sells it and puts the money toward your debt. It is important to understand that you still owe money.

If A Car Is Repossessed Do I Still Owe

If you struggle to make automatic payments, you may want to consider manual withdrawals. However, you should understand the consequences and weigh the options. Voluntary repossession can damage your credit, and you may still owe a significant balance to the creditor or collection agency.

How To Avoid Vehicle & Car Repossession In Arizona

To initiate a voluntary repossession, contact the lender and tell them you want to surrender the car. Specify the time and place to return the car and keys. (This saves the lender from having to call a tow truck to impound the car.) Be sure to note who you’re meeting, their contact information, and the date and time.

The lender will resell your car at auction, and the proceeds from the auction will go toward what you owe. You will then owe the balance minus the amount the car was sold for. This is known as equilibrium of scarcity or scarcity.

If you don’t pay the deficiency balance, the lender can take you to court for a deficiency judgment. State laws vary: This can only happen in a state that accepts default judgments for car loans and sells the car for fair value. Deficiency judgments are most common in cases involving mortgage foreclosures.[2]

While it’s impossible to know exactly how much a repossession will affect your credit, you’ll likely see a significant reduction. That’s because your payment history is the biggest factor in determining your FICO® score, accounting for 35%. Withdrawals such as late payments fall under this category.

Can You Return A Car?

Missed or late payments can cause your credit score to drop when you fall behind on your car loan. If you’ve already missed a car payment, your credit score may have been affected. However, the consequences could be worse in the event of a foreclosure because you have defaulted on your loan.

Debt sent to collections can negatively affect your credit score. When a creditor sells your debt to a debt collector, it’s known as a “discharge,” and the collection account is reported separately on your credit report.

An involuntary repossession is a loan default that can damage your credit score and stay on your credit history for up to seven years. This seven-year period begins on the date of the first missed payment that causes the default.

Even if you sell your debt to a collection agency, it will be considered a continuation of your account with the original creditor. If you have a balance on your account and the court issues a judgment against you, not only will you have to pay, but your credit history will be damaged. In fact, a judgment against you in a case brought by a debt collector can remain on your credit report for seven years from the date of the judgment.

Auto Repossessions Likely To Rise In 2021 As Pandemic Goes On

Because car repossession affects your credit score, you may be less likely to get a new loan for a replacement car — or other types of loans. If you can get a loan, lenders or dealers are likely to charge you a higher interest rate because they may see you as a loan defaulter.

A voluntary surrender can help you in some ways, but it won’t save you from the consequences of a car repossession.

Repossession is generally a last resort. It gives you cash, credit, and the use of a car for transportation to work. In light of the consequences of any repossession – voluntary or involuntary – it is worth exploring the options.

The first step is to contact your car lender, dealer or financial institution for assistance in managing your loan. Your lender may be able to negotiate a new payment plan. Extending loan terms will give you smaller monthly payments, but it will also increase the amount of interest you pay.

Financial Assistance For Car Repossession

Explaining your situation and reiterating your willingness to repay the loan will encourage the lender to help you come up with a plan that works for both of you.

You may want to check if you qualify for a lower interest rate or an extended repayment period. Alternatively, you can explore debt consolidation by taking out a new loan that is used to pay off the car loan along with other loans you owe.

Debt consolidation can simplify your debts by consolidating them into one monthly payment. This can make your debt more manageable and help improve your payment history, but depending on your personal credit history, it can negatively affect your credit score by reducing the average age of your accounts, which is used to calculate your FICO score, by 15%.

If your loan payments are more than you can afford, you may want to consider selling your car, especially if your car has a high resale value. Check resources like Kelly Blue Book to find out what your car is worth.

Is Your Car In Danger Of Being Repossessed?

You should talk to your lender because they will hold the car’s title until you pay off the remaining balance. If you can’t pay the balance, along with any fees, penalties, and interest, the lender may not agree to transfer the title. Therefore, it is important to know whether your car is worth enough to cover the loan balance and associated fees.

You can only remove incorrect information from your credit report, so if you repossess your car and report it to the three major credit bureaus, it will remain on your credit history for up to seven years.

If your car is repossessed or you can’t keep up with the loan payments on your car loan, your credit will be affected. Although most negative marks can stay on your credit report for up to seven years, they count for less than the age at which they are received. At the same time, you can work on rebuilding your credit so that you can improve your personal finances and qualify for a new car loan at a reasonable price in a timely manner.

Ana Gonzalez-Ribeiro, MBA, AFC® is a Certified Financial Advisor and a bilingual personal finance writer and educator dedicated to helping people in need of financial literacy education and advice. Her informative articles have appeared in numerous news outlets and websites, including The Huffington Post, Fidelity, Fox Business News, MSN, and Yahoo Finance. She founded the personal finance and motivation website www.AcetheJourney.com and Katherine B. Hauer translated the book Financial Advice for Blue Collar America by CFP into Spanish. Anna teaches personal finance courses in Spanish or English for the Working in Support of Education (W!SE) program and teaches workshops for nonprofits in NYC.

How To Get A Repo Off Your Credit Report (jan. 2024)

Disclaimer: Not providing financial advice. The content of this page provides general consumer information and is not intended to provide legal, financial or regulatory guidance. The content presented does not reflect the views of the issuing banks. Although this information may contain references to third-party sources or content, the accuracy of such third-party information is not verified or guaranteed. Credit Builder Account, Secured Visa Credit Card, and Level Credit/Lease Tracking links are product advertisements. Note the publication date of the original content and all associated content to better understand their terms.

By submitting my information, I agree to the Terms of Use, Consent to Use of Electronic Documents and Signatures, Privacy Policy, Disclosure of Customer Reports, and Customer Identification Program. Owning a car is a luxury, but it can take a good portion of your salary every month. According to Experian, the average monthly rent for a new car is $554 and $391 for a used car. If you have other large financial obligations, such as a mortgage or student loans, you may have trouble keeping up with your car payments.

Bad car loans can cause you to lose your credit and have your car repossessed. Here’s what you need to know about the car repossession process and your options.

By taking out a car loan, you have signed a legal contract to make the required monthly payments on time. If you don’t keep your end of the deal, the lender can repossess your car and sell it at auction. They can collect your car if you are at home, work or wherever you are going.

Car Repossessions Rise Amid Covid, With No Help, Relief For Consumers

Laws governing repossessed vehicles vary from state to state. In some states, lenders don’t have to notify you of their intent to repossess your car. So you can go out and find an empty parking lot instead of your car. Talk about a shocker!

The car repossession process can be scary and emotional. Here’s what you need to do to take control of your situation.

Don’t hide from the problem. Contact the lender immediately and find out why

If my car gets repossessed do i still owe, car totaled not at fault still owe, what to do if your car is repossessed, can i trade in my car if i still owe, if my car is repossessed do i still owe money, if your car is repossessed do you still owe, car totaled still owe on loan, what to do if car is repossessed, if my car gets repossessed do i still owe money, if my car is repossessed, if a car is repossessed do i still owe, car repossessed still owe money