How Do You Get Audited By Irs – If you’re one of the less than one percent of people who receive an IRS audit letter, fear not. Chances are, your tax return has been flagged due to one of the common triggers for an IRS audit.

For most mail audits, the IRS will ask you to explain or confirm something simple on your return, including:

How Do You Get Audited By Irs

Assuming you’ve been completely honest with your tax return, your IRS audit will likely pass with relative ease. However, if you were intentionally dishonest on your tax returns, you could find yourself in hot water. However, if you receive an audit letter, the first thing you should do is open it immediately.

How To Avoid Getting Audited By Irs On Taxes

If you’ve had a tax professional do your taxes for the year in question, call them to explain the problem. If he can’t help, or if you don’t have a regular tax professional, consult a qualified tax professional immediately and request a review of your return. If you need an experienced IRS audit lawyer to represent you in an audit, book a consultation now.

Here are some important things to keep in mind when identifying and responding appropriately to an IRS audit letter for the best possible outcome.

Just because you get a letter from the IRS doesn’t mean you’re being audited. In many cases, the IRS will send a letter simply asking for more information or clarification about the details listed on your tax return.

The IRS audit letter will be sent to you by certified mail, and you may notice that it is in an IRS audit envelope.

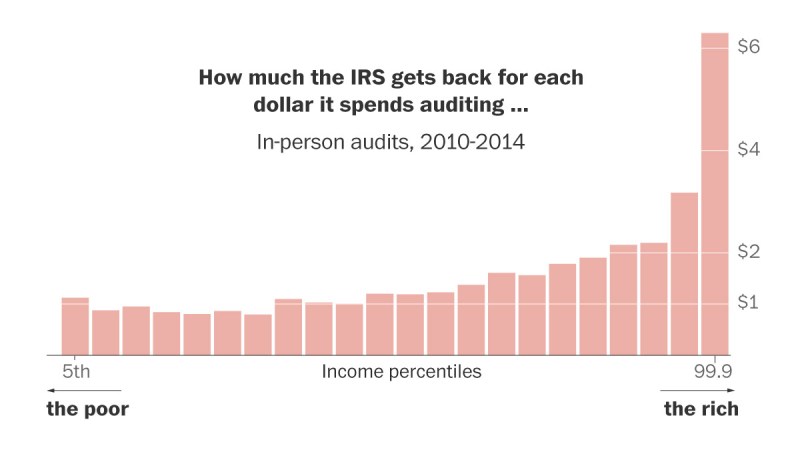

The Richer You Are, The More The Irs Gains From Auditing You: A Look At The Data

When you open it, your IRS confirmation letter will show your name, taxpayer ID, form number, employee ID number, and contact information. The first line of the IRS letter might be something like this: “Your income tax return (state or federal) for the year above has been selected for review.”

Your letter from the IRS or Finance Department will also state the main focus of the audit and the documentation you will need to provide to resolve it.

For most mail audits, the IRS asks for a receipt or documentation that proves the item was in your return, and an explanation of your circumstances that led to the request.

Often the IRS will send a certified letter because you are being audited. You may also receive a certified letter if the IRS has a problem with your tax return or if you owe back taxes. If there is no information on your tax return, the IRS may first send you a letter by regular mail, which may not be certified. However, if you do not respond in time, they may send you a letter by certified mail. Regardless of whether you receive a letter from the IRS, be sure to open it and do what it tells you to do.

Irs Audit Representation Services

Typically, an IRS audit letter comes from the Internal Revenue Service. An audit letter from the Ministry of Finance is also possible. The sender must be identified on the IRS audit envelope.

If you are audited by the IRS, you will receive a notice from the IRS by certified mail. You will not receive an audit notification by phone or email.

Below are examples of actual IRS audit letters our clients have received. Click to display each

There are different types of IRS audits, each with unique requirements. Understanding how you will be audited will help you decide what documents to collect and where to send them.

Irs Audit Representation

Correspondence Review: The IRS wants additional information about a portion of your tax return, such as statements or dishonored checks.

Office Audit: The IRS requires you to bring certain documents to the local IRS office where your audit will be conducted.

Taxpayer Compliance Assessment Program Audit: The purpose of this audit is to update the data used to create the computerized assessment program used by the IRS. In this case, your tax return will be thoroughly reviewed and each entry must be supported by documents, including birth and marriage certificates.

It is imperative that you respond to the IRS audit letter as soon as possible with a phone call or an audit response letter within 30 days. If you wait longer, you may be fined.

Factors That Could Increase Your Irs Audit Risk

Once you’ve read your IRS audit letter and determined why the IRS audited you, you’ll need to gather all the documentation to support the deductions you want. This may include invoices, appraisals, canceled checks or mileage reports.

The tax office generally has three years from the date of your application to audit you, so it’s a good idea to keep all your tax documents for at least that long. But for fraud or failure to file, they can go much further.

If you have no surviving documentation to substantiate your claims, try to enlist the support of third parties who may have a reasonable way to verify the veracity of your claims. For example, if you are audited for 2017 donations and do not have the documents, contact the relevant charities and ask them to send you the documents from their records.

@ #irs #backtaxes #taxhelp #taxattorney #taxdebt #Taxatrief #taxtok #tiktoktax #taxdebrelief #taxdebthelp ♬ Original Voice – Alyssa Whatley ⚖️ Tax Attorney

If You Get Audited By The Irs, What Happens?

This letter will also carefully address the discovery issues raised in your IRS audit letter, provide any documents attached to your letter, and request a time and date for a meeting to address the discovery issues.

While it may be tempting to write the letter yourself, there is some risk involved. The audit response letter must be complete, dotting every I and dotting every T, exactly as per IRS specifications. One mistake can delay the resolution of your audit.

An experienced tax attorney will know exactly how to respond to the IRS based on your unique circumstances and reasons for an audit. When done right, an audit response letter can quickly expedite the resolution of your review.

After you or your tax attorney submits your documents along with a written explanation of why you disagree with the findings, the IRS will review your information and send a response.

What Is An Irs Audit?

If you don’t respond to your IRS audit letter within 30 days, respond late, don’t respond at all, or don’t respond properly because you didn’t contact a tax attorney, in most cases the IRS will withhold it. . Items on the return, your tax return, and your bill, plus penalties and interest accrued since the filing date.

Just as it hurts you to respond late, incorrectly, or not at all, it’s also important not to submit multiple responses, as this will confuse the IRS. If the IRS’s central processing center doesn’t tie all of your letters together, it may seem like you don’t have a complete answer, preventing the IRS from understanding your situation and ultimately penalizing you.

Postal audits can take three months to over a year to resolve. However, if you respond accurately and timely with the help of a tax attorney, you have the best chance of getting things done in just a few months.

If the IRS examiner finds you owe more tax and adds penalties, you can simply agree to pay or ask the IRS appeals office to review your case. They will review your case and any new information available to you and provide you with an independent analysis.

Black Taxpayers More Than Three Times More Likely To Be Audited By Irs

If you end up paying more and the money isn’t available, you don’t have to pay right away. You can work with the IRS on a monthly payment schedule or request an extension of time. If you have financial problems, the IRS offers other arrangements that may allow you to delay payments or pay less than you owe.

While ignorance is bliss, the worst thing you can do when the IRS sends you an audit letter is to ignore it. The issue is not going away and you have a limited time to respond before the audit notice becomes a tax bill.

If you receive an audit letter from the IRS, contact a qualified tax attorney who can help you deal with the situation immediately for the best outcome.

My goal is to make the tax process as easy and stress-free as possible so you can focus on the things that make you happy.

Surviving An Irs Tax Audit: Daily, Frederick W.: 9781413312362: Amazon.com: Books

Are you a business owner who applied for an Employee Retention Loan (ERC) but are now panicking about all the scam news…

A disturbing new type of financial fraud is increasingly targeting your hard-earned retirement savings. It’s called “pig killing” and it involves scammers with caution… If you’ve received a letter in the mail from the IRS notifying you that your tax return has been selected for review, it’s time to prepare for an audit. Experienced tax attorneys

Being audited by irs, how do you get audited by the irs, when do you get audited by irs, what happens when you get audited by the irs, what to do if you are audited by the irs, how to get a business audited by the irs, audited by the irs, what to do when audited by irs, i got audited by irs, what if you get audited by the irs, what to do if audited by irs, what happens if you get audited by the irs