Does Insurance Go Up If Accident Not Your Fault – If you have a Galaxy Fold, unfold your phone or view it in full screen for a better experience.

ADVERTISING DISCLAIMER Many of the offers on this site are obtained from companies compensated by The Motley Fool. Compensation may affect how and where products appear on the Site (including, for example, the order in which they appear), but our opinions and ratings are not affected by compensation. We do not consider all companies or all offers in the market.

Does Insurance Go Up If Accident Not Your Fault

Most or all of the products here come from our partners who reimburse us. This is how we make money. However, our editorial integrity ensures that our experts’ opinions are not influenced by compensation. Terms and conditions may apply to offers listed on this page.

Must I Repair My Car After An Insurance Claim Accident?

All drivers need car insurance to cover them in the event of an accident. However, if they are involved in an accident, the cost of their policy will often increase. The question is, “How much does insurance cost after an accident?” The answer depends on where the driver lives and the insurance company. Here we take a closer look at car insurance to see how policy prices change after an accident.

How much a motorist will pay for car insurance if involved in an accident depends on many factors, including which state they live in and which car insurance company they use.

The amount is increased depending on the circumstances of the accident. However, the chart below shows how much the average rate increases for each state after a no-fault accident. These averages apply to:

Here’s what these cost increases mean for one’s daily budget. A driver lives in Arkansas and currently pays $1,200 a year ($100 a month) for insurance. If they are the driver involved in an accident, their insurance premiums can increase by up to 67%. So instead of paying $1,200 a year for coverage, they pay $2,004 ($167 a month).

How Long Do You Have To Go To A Doctor After A Car Accident?

Generally speaking, insurance premiums do not increase after a fault occurs. From vehicle repairs to medical bills, an at-fault driver’s insurance company will foot the bill. As long as the insurance company does not lose money, the policy interest is not increased.

“How long will the accident stay on your record?” The answer to the question is three to five years. However, in the meantime, drivers should make every effort to avoid traffic tickets and further accidents. If policyholders meet with another accident during this period, their premiums may go up.

It depends on what’s going on. Let’s say a driver lives in California. They slid down the road in the rain, hitting a neighbor’s mailbox and ripping off a car’s front bumper. Now they must decide whether to prosecute. They are certainly wrong, but there are a few things to consider. First, filing a claim means the accident, no matter how minor, stays on the insurance register for three to five years.

Plus, because they live in California, their insurance premiums could go up 68 percent. Let’s say you currently pay $1,200 a year for insurance. That means you could make $2,016 per year (or $168 per month). Multiply the $816 annual increase by three years (minimum time the accident is recorded). Total $2,448 ($816 x 3 = $2,448). Can they fix mailboxes and cars for less? In that case, it is better for the driver to pay out of pocket.

Will Your Car Insurance Go Up After A Hit And Run In Maryland?

Another thing to consider is your car insurance deductible. Let’s say they have a $1,500 deductible. If the cost to fix it is that high (or low), there’s no point in filing a complaint.

If a driver is involved in an accident and doesn’t know whose fault it is, they should call the police. If you are involved in an accident and the other person appears to be at fault, you should call the police, even if the other person has asked you not to. Insurance companies require a police report, which can help corroborate the at-fault driver’s side of the story if the other driver decides to change their version of events.

Accident forgiveness is a type of car insurance that protects drivers from rising premiums after an accident. Depending on the insurance company, accident discounts may be available after a period of safe driving or drivers may pay extra to add to their policy. If a driver is at-fault, his policy will not increase after his first at-fault accident.

If a driver is at fault for an accident, you can rest assured that your policy rates will increase. If so, all is not lost. Here are five possible ways to lower your prices.

Safety Tips For Your Teen Driver

There is no reason not to shop around with other insurance companies after a rate hike. It’s actually a smart move for drivers to shop around each year to get the highest coverage possible within their price range. Depending on the severity of the accident, policyholders can purchase high-risk auto insurance. No insurance company ignores at-fault accidents, but some insurance companies charge less than others.

If the motorist currently has a low deductible, you can lower the cost of your policy by increasing your deductible. Until then, drivers should check their budgets and make sure they have enough saved up to cover the excess cost in the event of another accident.

You may miss out on discounts when purchasing car insurance. Or someone’s circumstances change, making them eligible for a waiver. Here are some of the most common car insurance discounts:

Many insurance companies consider credit scores when determining policy rates. If your score is low when you first purchase your policy, you can take steps to improve your score. If your credit score improves, you can ask your insurance company for a rate review.

Handling A Car Accident In Malaysia

Taking a defensive driving course or accident prevention course can lower the cost of a driver’s insurance premium. The amount varies by insurance company, but it’s a discount worth considering.

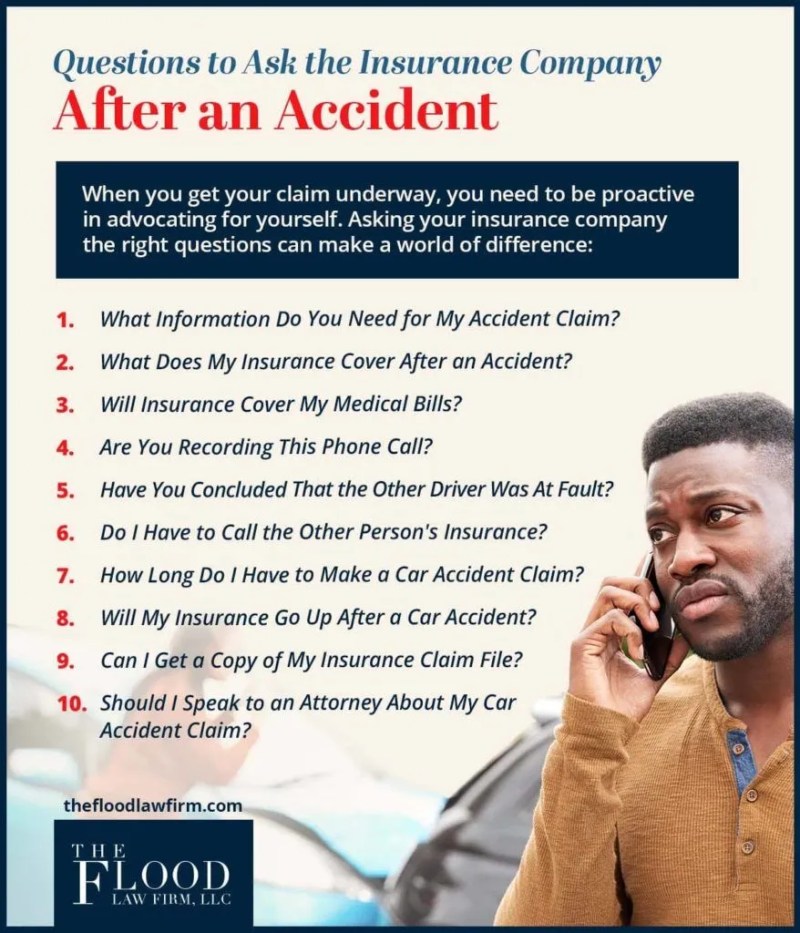

The average driver has a lot on his plate. Worrying about changes in car insurance premiums in the event of an accident should not be one of them. If you’re worried about your insurance premiums going up after an accident, the first step is to contact your car insurance company to see if they offer accident forgiveness. Some insurance companies automatically apply for accident deductibles after a driver has been accident-free for a certain number of years. Other plans allow accident forgiveness to be added to their standard policy for a small increase in premiums. Here are some questions to ask when contacting your insurance company:

The first and most important step is to purchase insurance. The next step is to ensure that the coverage matches the level of risk you are willing to take. If you haven’t recently compared prices from several insurance companies, you may be pleasantly surprised by your choices.

Check out our list of the best car insurance companies. Our most popular offers include great deals like low prices, bundled discounts and great service.

What Is Non Owner Car Insurance? (2024 Guide)

Dana George holds a bachelor’s degree in management and organizational development from Spring Arbor University. He has been writing and reporting on business and finance for over 25 years and is passionate about his work. Dana and her husband recently moved to Champaign, Illinois from Fighting Illini. Although he doesn’t think oranges are for most people, he thinks they really enjoy champagne.

Ashley Murray is a former history museum specialist who joined the world of digital content writing and editing in 2021. He holds a bachelor’s degree in history and philosophy from Hood College and a master’s degree in applied history from Shippensburg University. Ashley loves creating content for the public and learning new things to teach others, whether it’s salt mining, sewer donkeys, or personal finance.

Share Page on Facebook icon This icon will share the page you are on via Facebook. Blue Twitter icon Share this site via Twitter LinkedIn icon This image links to Share this page via LinkedIn. Email icon Share this site using your email address

We believe in the Golden Rule, so editorial opinions are ours alone and have not been previously verified, endorsed or endorsed by the advertiser. Ascent does not cover every offer on the market. Ascent’s editorial content differs from The Motley Fool’s editorial content and is created by a different team of analysts.

How A Car Accident Can Impact Your Car Insurance Rate

Dana George has no position in any of the shares mentioned. Motley recommends a gradual approach. Motley has a disclosure policy.

Ascendant is a motley

If your not at fault in an accident does your insurance go up, does insurance go up after an accident that's not your fault, do insurance rates go up after accident not your fault, if a car accident is not your fault, if accident not your fault, if an accident is not your fault does insurance go up, what to do if car accident not your fault, if i am not at fault in an accident will my insurance go up, if accident is your fault, does your insurance go up if your not at fault, does your insurance go up if it's not your fault, if a car accident is not your fault does your insurance go up