Can I Trade In My Financed Car – The content team brings you the best car reviews, news and research tips to help you find the perfect car.

Car finance companies are pretty good at predicting the residual value, which is the value of the car at the end of the lease term. They are good because they have to be – the residual value is usually the basis of the rental calculation. But sometimes the market fluctuates and some vehicles can be worth more than the residual value. One such change was the COVID-19 pandemic.

Can I Trade In My Financed Car

Used car prices have soared due to a shortage of semiconductor chips and supply chain delays that have made new cars scarce in recent years. In turn, these market forces have shifted consumer demand, creating a shortage of used cars and leaving dealers in dire need of inventory. As a result, experts say, your expiring rental car could be worth more than expected.

How Long Are You Responsible For A Car After You Sell It?

“Used prices are down slightly from the 2022 peak, but are still significantly high compared to pre-pandemic prices,” said Jessica Caldwell, CEO of Insights.

The good news for lessors is that this is unlikely to change significantly because the supply of used cars will remain tight for the next few years, keeping prices high, Caldwell said.

With this in mind, you should first determine if you have equity in your current leased car. Residual value is also the amount you can use to buy the car at the end of the lease, so you want to know if the current value of the car exceeds the residual value. As you usually have the right to buy the car at the end of the lease term at this residual value, you can benefit from the leasing company’s incorrect lower value. On the other hand, if the value of the car is less than the remaining amount, you can rent the car at no additional cost.

This strategy is not available to everyone. Many car finance departments do not allow third parties to buy back a leased car. And that list has grown in recent years as dealers, often reliant on used car lease returns, desperately need cars to fill their lots and showrooms. Brands such as Acura, BMW, Honda and General Motors changed their rules in 2021 to prohibit the sale of leased cars to third parties. In other words, you can have your car appraised to get an independent estimate of its value, but you won’t be able to take advantage of the offer at one of our participating dealers. In this scenario, the options remain: take your car to any dealer of the same brand and ask for a quote, or buy it directly from the rental company. See steps 2 and 3 for details.

Our Answers To Common Questions About Honda Financing

We try to keep this list up to date, but the rules are constantly changing. Check your options with your rental company. Please note that in some of the limited cases below (such as Audi and Volkswagen) a third party buyback may be allowed if the buyer is a dealer and not an individual. So read the fine print to fully understand the options.

If you’re looking to potentially use your own funds, your first stop should be the car evaluation page. From there you can get the prices of cars for trade-ins and private parties. We also give you the ability to get an instant quote for your vehicle, giving you a solid price to compare against.

Then find the residual value of the lease. Subtract the residual value from the trade-in value and that is the approximate equity you may have. Knowing the current market value of your rental car and showing dealers who have done your price research will strengthen your negotiating position.

If you have a year or more on your rental car and want to check your current equity, call your rental company and ask about the buyback price. Subtract the purchase price from the car’s current market value to see if you have equity.

Car Loans With No Down Payment: What You Need To Know

If you have equity in your rental car, you can convert it into cash as follows. However, keep in mind that these strategies may not work for everyone:

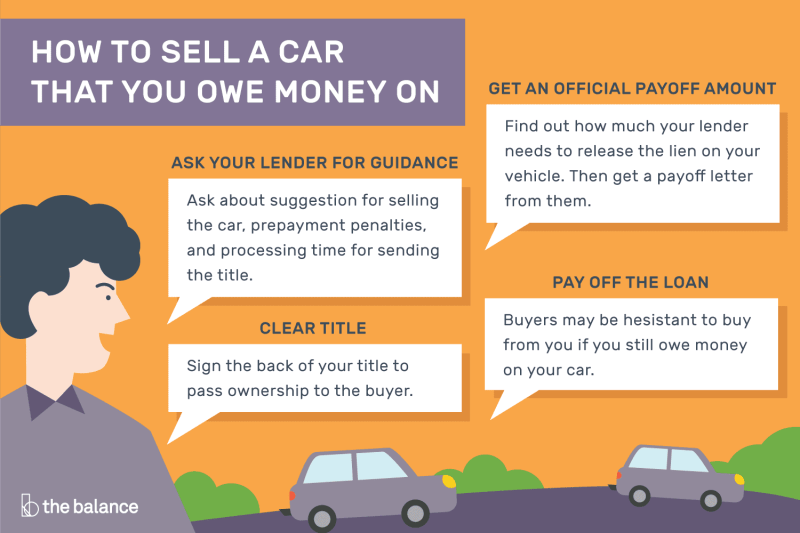

1. Sell the leased car and get a check. The fastest way to sell your rental car is to get an instant offer that is valid for seven days and can be used at participating dealers. Just enter a few details about your car and you will soon receive a price for your car that can be paid on the same day. Of course, not all rental cars have equity. But as the lease return date approaches, keep an eye on its market value.

CarMax used car supermarket is another place to get equity from your rental car. In most cases, you can sell your CarMax rental car the same way you sell any other financed vehicle, according to the company. He evaluates the car or truck and then contacts the leasing company to get the final price and handle any capital.

You can also give the car to any other dealer, not just the one you rented from, and let the dealer buy the car for the trade-in price. The dealer pays the rental company the amount you owe and gives you a master check. However, in this case, you should not expect money immediately. The dealer will send you a check once they receive the correct title and make sure there are no outstanding parking tickets on your vehicle. To be sure, ask for a written exchange agreement notifying you of the debt.

How To Get My Name Off A Joint Car Loan

2. Sell your rental car to a neighbor, friend or family member. This method requires a bit of trust, so it helps to sell your car to someone you know. But you can sell to any buyer and get a private car price that is higher than the trade-in price dealers pay.

Here’s how: Once you’ve found a reliable buyer, ask them to send a check for the purchase price to the leasing company. Once you receive title (the leasing company only sends it to lease the car), sign it to release your interest in the car and transfer the title to the buyer. After this, the buyer can register the car and pay the sales tax. But beware: If the buyer waits more than 10 days, the government may try to collect sales tax from you and wipe out your profits.

According to the Auto Club of Southern California, the way to avoid this situation is to pay the sales tax and DMV fees as soon as possible and then return to the DMV to complete the transaction. This transaction is called a “leaseback”. Contact your state’s DMV for more information.

3. Use the capital as a down payment for your next car. In this case, the equity in your current car becomes a cash payment for the new car. Once you know you have equity, you can take your car to any dealer for a new lease or sale. In fact, used car prices are now so good that they reduce the impact of buying new or leasing, as about 80% of car buyers today pay more than MSRP. Not all dealers will offer you the same amount to buy back your rental car, so you may need to shop around for the best deal. The amount must be close to the trade-in price or better.

Calculating Your Car’s Trade In Value In Minutes

Diana Whitmire, director of fleet and Internet for Toyota West Coast in Long Beach, Calif., said she uses leaseback capital to help her customers in several ways. He had one client with two cars – one was a leased car with equity and the other was a purchased car that was “upside down”, meaning the loan balance was more than the car was worth. “In such a case, one was the other” to repay the loan, he explains. Experts say you can get more money if you sell your Toyota to a Toyota dealer, although any dealer can handle the transaction.

It is important to make sure that all the numbers add up. Agree on the exact amount of equity you will receive and find it in the down payment field of the contract. Alternatively, you can also use your home equity to pay the fees required to start a new lease instead of paying the money out of your own pocket. Finally, if you live in a state that allows vehicle sales tax conversion,

Trade in financed car carmax, can i trade in my financed car for another car, trade in my financed car, can i trade in a financed car, can i trade in my financed car for a lease, how can i trade in my financed car, can i trade in my financed car, trade in my financed vehicle, can u trade in a financed car, trade in financed car calculator, can you trade in a financed car, trade in financed car