Can I Trade In A Financed Car For A Lease – If you’re in the market for a new car but still have money owed on your current car, you may be wondering how to trade in a car that isn’t paid off. One important factor is whether your car is worth more than it is. Here’s what you need to know.

If you’re considering trading in your car, it’s important to know how much you can afford before you go to the dealer. Without this information, you may receive a lower offer from the broker without knowing it.

Can I Trade In A Financed Car For A Lease

You can check your car’s valuation online using Kelly’s Blue Book or other valuation guides. It is a good idea to consult several such guides, as they list different prices and often come with different amounts.

Worthless Auto Trade Ins Signal Riskier Loans

Remember that you won’t get nearly as much out of the deal as you would if you sold the car privately. But knowing the value of your car can save you from using it.

If your car is worth more than you owe, you’re in an easy situation. For example, let’s say the dealer gives you $13,000 for your car and you still owe $11,000 on the loan. When you trade in your car, you will receive the difference ($2,000) which represents your equity in the car.

If you are financing your new car, you can use the equity in your old car to make your payments. This can be a way to lower the total cost of your new loan. You can add more money if you want to make a larger payment and borrow even less. If you pay cash for the car, the dealer can deduct your trade-in value from the amount you paid.

If you have more of your current debt than you can get in the business, then your credit score is bad. This is usually done if you are trying to trade in a new car, as cars depreciate quickly in the first few years of ownership. After you’ve owned the car for a while, the depreciation will decrease and your payments will gradually increase. So, if you have bad equity in your car, you can wait to trade it in until the balance of the particular loan exceeds the value of your car.

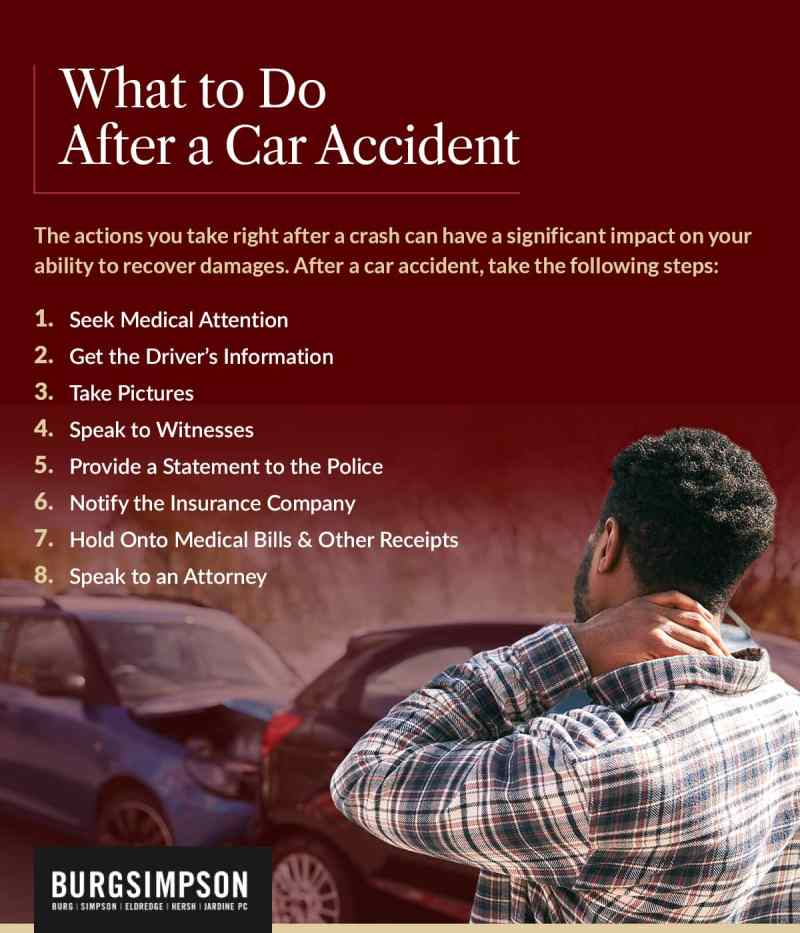

How Soon Can You Trade In A Financed Car?

If not, you will see the difference. Your dealer may offer to roll that amount into your new loan, but be careful. This means you will start your new loan with the correct balance. So you may find yourself in a similar situation in a few years if you go into business in this car.

It is possible to trade in the car you are currently renting, and it works like trading in a car with a special credit rating. First you will need to contact the rental company or check your rental information to find out what the cost of buying a car is. This is the amount you have to pay if you want to buy the car right before the end of the lease term. You will also want to find out if there is an early termination fee.

Once you have this information, you can contact the dealer where you bought your new car and ask them to work directly with the rental company. Because early termination or other fees are often charged during rent payments, you may not receive the full bargain price for your rent. So, as with selling a car with bad equity, it may make sense to wait until the end of the lease term and exercise the option to buy.

Of course, at this stage you don’t have to buy a car at all, just give it to him and go. And if you don’t plan on driving that car for a while before you sell it—or the car dealer wants to pay you more than the option to buy is worth—you might be smarter from a financial standpoint.

Car Expert Can Help Me? Which Year Will Break Even?

If the trade-in value of your car is more than the balance of your current loan, then you’re good to go—you can simply pay off the old loan and apply the difference to the value of your new car. But if your car is worth more than its trade-in value, then you have to settle. In this case, perhaps the best move is to wait until you pay off the debt.

Requires authors to use primary sources to support their work. These include official documents, government records, original reports and interviews with industry experts. We also publish original research from other reputable publishers where appropriate. You can learn more about the principles we follow in creating quality and unbiased content in our Editorial Guidelines. When buying a new car, it’s tempting to go beyond the basic model and spend on extras. This can include things like DVD players, navigation systems or any other automation. With the average price of a new car hovering over $40,000, it’s important to make sure you can afford the car.

An unexpected layoff or job loss, or a situation that affects your ability to make car payments, may leave you wondering what options you have to avoid repossession. Specifically, you may ask: Can you return the car you paid for? The answer is: it depends.

If you take out a car loan to finance the purchase of a new or used car, there are many options to pay off and get out of the loan agreement or make your loan payments more affordable.

Ways To Boost Car Trade In Value

There are many reasons why you may need to restore a car. Returning the car can be understood in any of the following situations:

If you still need a car but can’t afford it, you should consider trading in your car for a cheaper one. You also have car loan payments. But if the vehicle is cheaper, the new one may be more affordable for your budget than the previous one.

Lemon laws vary from state to state, so if you’re trying to get a vehicle repossessed on the grounds that it’s a lemon, be aware of the time limits that apply.

If you can’t make the payments, repossessing the vehicle may be necessary. But before you return it, you can talk to the dealer to see what kind of help they can provide. For example, if your financial problems are temporary, the broker may allow you to skip a payment or two and add them to the end of the loan period.

Can You Return A Financed Car To The Dealer?

If you finance the purchase of a car through a dealer, you may be able to get a refund. But it will depend on the car dealer’s return policy and policy. Similar to lemon laws, there may be a time limit on how long you have to return your loaned car to the dealer.

In some cases, the dealer may be willing to return the impounded vehicle if necessary to avoid repossession. Here it is important to remember that the value of the car decreases quickly. Even after a few months of owning the car, you may end up owing more than its current value. This can mean financing to get out of the car with a loan.

For example, if your car was down to $20,000 and it’s still worth $25,000, you’ll pay the $5,000 difference even if your dealer agrees to take it back. So it is worth considering when deciding whether or not a car loan is the best option.

If the retailer refuses to cooperate with you, consider filing a complaint with the Better Business Bureau, your state’s attorney general’s office, the Federal Trade Commission, and/or the Bureau of Consumer Protection.

Can You Trade In A Financed Car?

If you can’t afford the car, you can ask the dealer to agree to a voluntary return. In this case, you tell the lender that you can no longer make the payments and ask them to take the car back. You hand over the keys and can provide the money to pay off the loan.

Voluntary return allows you to return a donated vehicle without going through the full restoration process. This can save some damage to your credit score, although voluntary deposits may be reported to the credit bureaus.

Ask about any penalties or fees you may have to pay for a voluntary return and how to report it to the credit bureaus.

If your dealer won’t let you return the car because it’s too worn or the reasons for your return aren’t covered by the return policy, you can try other things.

How To Trade In A Car With A Loan

If affordability is an issue with monthly payments, you may want to consider reviewing your car loan. Worth it

Can i trade in a financed car, how soon can you trade in a financed car, can u trade in a financed car, trade my financed car for a lease, trade in financed car, can you trade in a financed car, can i trade in my financed car, can you trade in a financed car for a lease, trade in financed car for lease, can i trade in my financed car for a lease, can i trade in a financed car for a lease, can you trade in your financed car for a lease