Can I Trade In A Financed Car – If you’re looking for a new car but still owe money on your current car, you may be wondering how to trade in a car that you haven’t paid for yet. One major factor is whether your car is worth more than your loan balance. Here’s what you need to know.

If you’re planning on trading in your old car, it’s important to know how much your car is worth before you head to the dealer. Without this information, you may end up accepting a lowball offer from a dealer without realizing it.

Can I Trade In A Financed Car

You can research your car’s value online using Kelley Blue Book or other appraisal guides. It’s best to consult several such guides, as they calculate this value in different ways and often come up with different numbers.

Should You Trade In Your Car Or Sell It Privately?

Remember, a trade-in will never bring you as much profit as selling the car privately. But having a rough idea of your car’s value may prevent you from taking advantage.

If your car is worth more than you owe on the loan, you’re in a relatively easy position. For example, let’s say the dealer buys your car for $13,000, but you still owe $11,000 on the loan. When you trade in a car, you get the difference ($2,000), which represents your equity in the car.

If you finance a new car, you can use the equity in your old car to pay for the down payment. This can be a way to lower the overall cost of a new loan. You can add more money if you want to pay more upfront and borrow less. If you pay cash for the car, the dealer can deduct your trade-in from the total price you pay.

If you owe more on your current loan than you could get for your trade-in, you have negative equity. This often happens if you’re trying to trade in a relatively new car, as cars depreciate quickly in the first few years of ownership. Once you own the car for a certain period of time, depreciation decreases and your loan payments pay off over time. So if you have negative equity in your car, you may want to consider waiting to trade in until your loan amount exceeds the car’s value.

Advantages Vs Disadvantages Of Trading In A Car

Otherwise, you will have to make up the difference. Your dealer may offer to roll that amount into your new loan, but be careful. Doing this means you will start a new loan with more negative equity. So when you go to trade in that car a few years later, you might find yourself in the same situation.

You can trade in a car on your current lease and it works the same way as trading in a car with an outstanding loan balance. You first need to contact the leasing company or check your lease statement to find out how much the car will be purchased or paid for. If you want to buy the car before the end of the lease, you have to pay the same amount. You’ll also want to know if your lease requires an early termination fee.

Once you have this information, you can contact the dealer where you purchased your new car and ask them to work directly with the leasing company. You may not get a full trade-in with a leased car because leases often require early termination or other fees. So, like trading a car with negative equity, it might make sense to wait until the lease is up and exercise the purchase option.

At that point, of course, you don’t need to buy the car at all, you can simply hand it over and drive away. Unless you plan on driving the car for a while before trading it in, or the car dealer is willing to pay you more than the cost of the option, this is a better move from a financial perspective. this is possible

Trading In A Car That’s Still Financed

If your car’s trade-in value is greater than your current loan balance, you’re all set – you just pay off the old loan and apply the difference toward the price of the new car. But if you owe more on the car than its trade-in value, you’ll have to make up the difference. In this case, waiting until you pay off more of your loan may be a better financial move.

Writers must use primary sources to support their work. This includes white papers, government data, original reports and interviews with industry experts. Where appropriate, we also refer to original research from other reputable publishers. You can learn more about the standards we follow to produce accurate and unbiased content in our Editorial Policy. If you want to upgrade to a new car, trading in a financed car may be a viable option, but it may have some financial implications. Here’s a closer look to help you make the right decision.

So you’re considering trading in a vehicle that’s currently being financed. So, is it possible? How quickly can you negotiate to finance a car? Can you trade in a car financed by someone else or financed through a lease? Is it possible to exchange a financed car for another vehicle? What if your financed vehicle is damaged – could it cause big trouble? We provide complete details to help you make the right decision.

Reply promptly? Yes, it’s possible to trade in a financed car, but the process can be a little more complicated than trading in a fully paid-for car. When you trade in a car, the dealer typically pays off your outstanding loan and applies the remaining value of the trade-in vehicle to your new car.

Trade In Value: Maximizing Your Trade In Value With In House Financing

However, you should be aware that if you still owe more on the car than its current trade-in value, you may have negative equity, also known as a loan “inversion” (also known as “inversion”).

, in this case, you must pay the difference between the loan balance and the trade-in value before completing the trade-in process.

Before negotiating to finance a car, it’s important to understand your current loan balance and the car’s trade-in value. You can get an estimate of your car’s value from sites like Kelley Blue Book or NADA Guides. It’s a good idea to check with your lender to see if there are any prepayment penalties or other fees for paying off your loan early.

If you’re looking to upgrade to a new car, financing your car trade-in may be a viable option, but it’s also important to understand the financial implications and work closely with your dealer and lender to ensure the process goes smoothly.

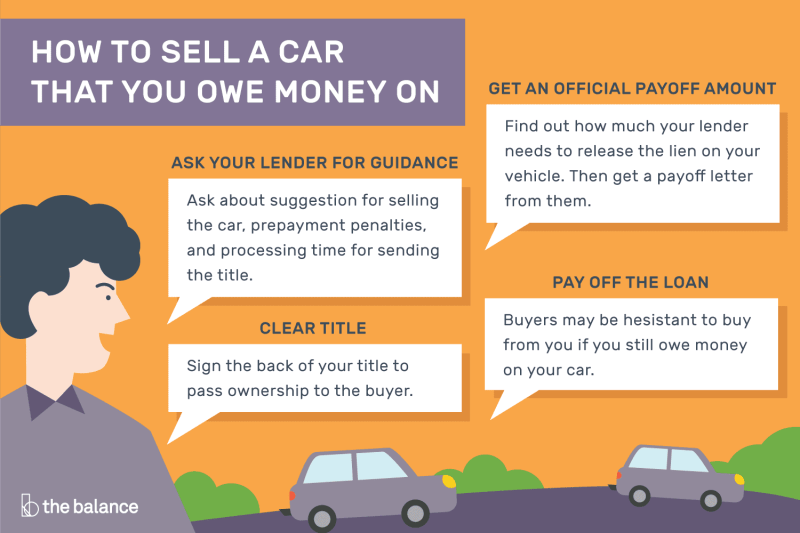

Can You Sell A Car Under Finance?

The time it takes to negotiate to finance a car depends on several factors, such as the terms of the financing agreement, the amount of equity you have in the car, and your financial situation. Generally speaking, you can trade in a financed car at any time, but there are some important things to remember:

If you owe more on your car than it’s currently worth (also called negative equity or loan “inversion”), now may not be a good time to trade in your car. You’ll have to pay the difference between the loan balance and the trade-in value, which could increase the cost of the new car.

Check the terms of your financing agreement to see if there are any prepayment penalties or fees for paying off the loan early. If so, you may need to wait until the penalty period is over before trading in your car.

If you’re struggling to pay off your current car loan, now may not be the best time to trade in your old one. You may want to explore other options for recovering your loan, such as refinancing the loan or negotiating a payment plan with your lender. Before trading in your car, get your finances in order.

Here’s How To Get A Car With No Down Payment

It’s usually best to trade in a financed car when you have positive equity in the vehicle and are in a good financial position to apply for a new car loan. However, the timing of your trade-in ultimately depends on your personal situation, so it’s best to speak with a trusted financial advisor or dealer representative to help you make an informed decision.

First, the person who financed the car (called the primary borrower) needs to be involved in the trade-in process. They will need to provide trade-in approval and may need to go to the dealership to sign paperwork.

Second, you need to consider how much you owe on the car. If there is negative equity

Can you trade in a financed car, can you trade in a car you just financed, can i trade in a car i just financed, how soon can you trade in a financed car, can i trade in a financed car, can i trade in my financed car for a lease, trade in financed car, can i trade in my financed car, can you trade in a financed car for a lease, how can i trade in my financed car, can i trade in a financed car for a lease, can u trade in a financed car