Can I Sell My Home If I Still Have A Mortgage – The real estate market is growing in the second half of 2020. When housing experts look at the coming winter, their predictions are not so cold.

Mortgage interest rates, which are historically low, are expected to remain low this year. But the number will not remain as low as it is now. This could be the last chance for homebuyers to score low prices – and today’s buyers are ready to take action.

Can I Sell My Home If I Still Have A Mortgage

Take these steps to sell your home faster. Remotely pre-qualify for your new mortgage now. As Bankrate explains:

Want To Know, Can I Sell My Home If It Is In Foreclosure?

. However, the possibility of a rate cut to 2.5 percent or lower has faded as the US economy recovers.”

“Demand for home purchases remains very strong… However, we are likely to end the year with more homes sold in 2020 than in 2019… With low mortgage rates and an ongoing job recovery, expect more contracts to be signed still a long way to go.”

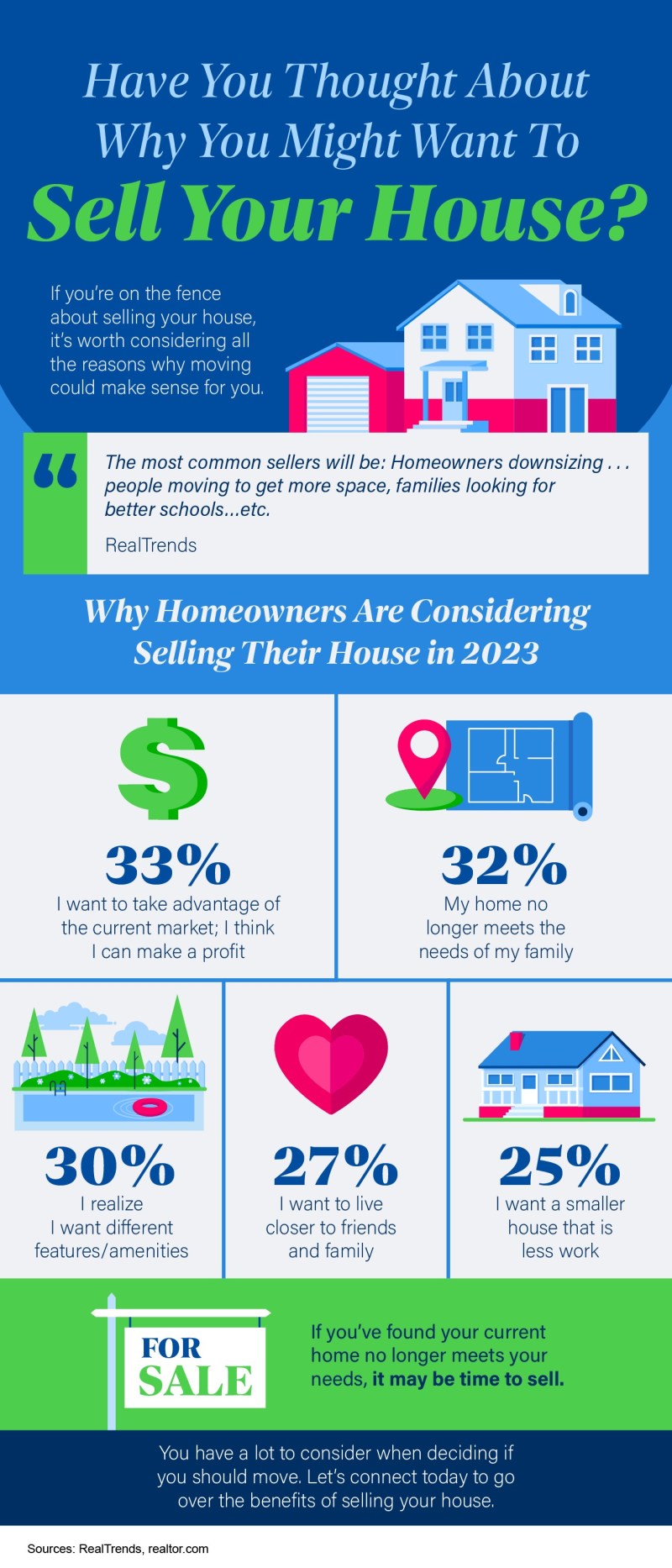

There is only one problem. Currently there are not enough houses for sale. Home supplies are very limited. Experts’ eyes are on homeowners, waiting to see if they’ll list this winter or hold off until spring.

Realtor.com Chief Economist Daniel Hale emphasizes that it’s better for sellers to take advantage of this time — to sell sooner rather than later. Fall buyers are staying on the market longer than usual. If this trend continues, Hale expects to see more buyers in the winter as well. “So this winter might be a good time to sell,” he said.

Things To Consider When Selling Property With An Open Insurance Claim

With homebuyers expected to be just as active in the coming months, sellers looking for stronger deals don’t have to wait until spring. Housing experts conclude that this winter market may be bigger than ever. Pre-qualifying for your new mortgage now, before you put your home on the market, can help speed up the process and allow you to move into your dream home before the new year.

House prices are falling and house prices are still strong – making now the perfect time to sell. The lower your rate, the less you’ll pay each month on your new mortgage. Low mortgage rates also attract more buyers, so your home may sell faster. Requalify now.

Are you a veteran? Here’s How To Save On Your Home Loan And Property Taxes November 11, 2022 10 Things I Wish I Knew When I Became a Homeowner October 28, 2022 Have You Heard The News? We’re 9th in the Nation for Work-Life Balance October 24, 2022 Tell Your Clients: It’s Still a Good Time to Buy October 18, 2022 Press Release – Cornerstone Home Loans Completed Acquisition at Roscoe State Bank on October 4, 2022 if I want to sell house but still have a mortgage?

Do not worry. At , we’re committed to helping you sell and get cash when your property meets our criteria, even if that means there’s still a lot of work to be done – like a mortgage.

Questions To Ask Yourself When Selling Due To Illness

If the property has a bank mortgage and you cannot afford to be debt free, we will help you cancel the mortgage in a few simple steps. Learn more with us below!

Step 1. You need to notify the project owner so that the certificate can be transferred. The developer needs 7-10 days to prepare it.

Step 2. You will contact your bank to announce the day you want to cancel the mortgage and confirm the amount. For example, on March 25, 2022, the amount due is VND 2,650,000,000.

Step 1. You will be authorized to pay off your mortgage. To do this, at the notary’s office, you will sign the following agreement:

Should You Fix Up Your Home Or Sell It As Is?

Whether you are looking to sell your home or need additional support, we can help! Let us know when you need to sell and we’ll guide you through all the necessary steps.

You can contact our team on mobile/Zalo/Whatsapp (+84) 964 245 404 or email contact@get.com to get started!

Meet Our Product Management Executive Hoa Fung – Super Intern #1 Meet Hoa Fung – Product Management Executive at ! If you ask anyone about Hoa’s greatest strength, they will tell you that she gets the job done! read again

Product Registration Fee – How much do I have to pay? Registration fee is one of the significant costs involved in Equity Installment and Unlock products. In this article, you will learn everything you need to know about registration fees. read again

Sell My House Fast: Features Buyers Want

What documents do I need to prepare before selling? Before our transaction, you must prepare some documents about your property. It will help us get a general idea of the home you want to sell so we can better support you. Let’s find out what it is! Read more You want to sell your home, but you may have made a large profit on the sale and wonder if you should pay tax on the profit. This is a question that comes up regularly in our Free Facebook Group and Tax Reduction Program that we want to answer.

Fortunately, the IRS has something called the “home sale gain exclusion” that allows you to potentially not pay tax on the gain on a personal residence. However, there are a few things you need to know to meet the requirements that we will discuss here.

If you qualify, you can exclude up to a certain amount of the gain from the sale of your personal residence. Benefits you can turn off are:

To qualify, you must pass two separate tests, an ownership test and a use test.

Rent To Own Homes: How The Process Works

If you have a gain above the exemption, then you need to report it as taxable gain. This will be done on Schedule D of your Form 1040.

Note: If you do not meet the above test but are forced to sell due to a job change, health reasons or other unforeseen circumstances, you may still be eligible for the pro rata gain exemption.

If you use part of your home for business, the part of your business home still qualifies for the exemption. However, if your office is not located in your actual home, but a building that is not connected to the property (ie: garage, warehouse, etc.), you need to allocate the profit between the part of your home versus your office.

To avoid this, if you plan to sell within the next 2 years, you can move the office to your home 2 years before the sale.

How Soon Can I Sell My House After Purchase In Australia?

One important thing to note is that if you have ever claimed depreciation from your business for your home office (regardless of whether the business is attached to your home or not), you will need to report Section 1250 retained earnings for that portion of the depreciation.

After all, the home sale exemption is a great gift from the IRS to avoid taxes on the sale of your primary residence. Therefore, you want to make sure that you have prepared everything correctly to ensure that you qualify.

One more thing, if you plan to convert your home into a rental property, you may want to consider selling your home to an S Corp and then using it as a rental. This can be complicated and unreasonable in every situation, but we’ll cover it in the Tax Reduction Program if you’re looking for more information about it.

Bottom line, if you’re selling your home, be sure to talk to your advisor or ask about our Tax Reduction Program to make sure you can take advantage of it.

Can I Sell My Home If I’m Behind On My Mortgage?

Don’t be like our good clients who come into tax season and tell us about the house they’re selling (without coming to us first) after only owning it for 19 months!

Now is the time to start paying less tax. Join TaxElm and start eliminating taxes and growing your wealth! Do you have questions or want to discuss how we can help you sell your home? Call us 24/7 anytime

In this article, we’ll look at why homeowners may need to consider selling their home due to illness or to help cover medical expenses.

It’s common for people to sell their homes due to ill health, and as real cash home buyers, we’ve helped many homeowners move on with their lives FAST and hassle-free.

Can I Sell My House If I’m Behind On Mortgage Payments?

We never know what will happen in our life. The world is full of ups and downs, but the most health-conscious people can fall ill with unknown or undiagnosed illnesses, causing them to require a large amount of medication or treatment.

The main question is do you have to sell the house to pay for maintenance or is there a way to survive without selling? A case can be made for both.

As mentioned earlier in the article, a case can be made for selling your home to pay for your care or keeping it and using other funds to pay for your care.

Even if your care and treatment costs a lot of money, the main thing is to remember that you don’t necessarily need these expenses

Can I Sell My House If I’m Behind On Payments?

Can you sell your home if you have a mortgage, can i sell my home if i still have a mortgage, can you sell your house if you still have mortgage, can i sell my house if i still have a mortgage on it, can you sell your home if you still have a mortgage, can you sell your house if you still have a mortgage, can you sell a house if you have a mortgage, how do you sell your house if you still have a mortgage, can i sell my home if i have a mortgage, can i sell my house if i still have a mortgage, if i have a mortgage can i sell my house, can you sell house if you still owe mortgage