Trade In Car That You Still Owe Money On – There are many reasons why you might decide to sell your car before it’s paid off: the loan payments are too high, the car doesn’t work for a test drive, or it just doesn’t suit your needs. He

You can sell the car even if you still owe on the loan. This only adds one step to the sales transaction: closing the loan with your lender.

Trade In Car That You Still Owe Money On

Your best course of action depends on how you plan to sell the car and whether you have positive or negative equity in the vehicle. While negative equity (worth more than the vehicle loan) can be a challenge, recent increases in used car prices are helping some sellers avoid this situation.

How To Sell A Car With A Loan

If you’re wondering where to start with selling your vehicle and fixing your payments, here’s what to do:

The editorial section is your source for automotive news and reviews. In accordance with its long-standing ethical policy, editors and reviewers do not accept gifts or free travel from car companies. The editorial section does not contain advertising, sales and sponsored content.

101,000 Kia Carnival, Sportage recalled for roof molding Jan 23, 2024 2024 Mercedes-Benz E-Class Facelift from $63,450 Jan 23, 2024 Close with 2025 Chevrolet 2025 Reading Equinox, 4

Breaking News: How Tesla Model Y and Jeep Grand Cherokee 4xe Handle Chicago’s Sub-Zero Temperatures By Brian Normile and Damon Bell January 18, 2024

How To Trade In A Financed Vehicle (4 Things You Need To Know!)

2024 Acura MDX Type S Quick Spin Expert Review: Performance for the Price By Jennifer Geiger News Editor

2024 Lotus Eletre R Fast Spin Expert Review: Not Your Traditional Lotus By Detroit Bureau Chief Aaron Bragman

2023 Mercedes-AMG SL43 Quick Turn Expert Review: Proving You Don’t Want a V-8 By Aaron Bragman Detroit Bureau Manager There are many reasons why you might want to get rid of your current car, but selling the vehicle still applies to it, which means you still have a loan. cars and debts on vehicles, abandoned. Will be married. But that doesn’t mean you can’t sell in person.

When it comes to selling a vehicle, we don’t have many options. For many owners who are still paying off their vehicle loan, the easiest thing to do is go to a bank preferred dealer where there is a more experienced sales team that knows what to do. There are pros and cons to this, as well as pros and cons to selling your vehicle privately on social media platforms and online, especially if you have an active car loan on the car. However, just because you don’t have the title in hand doesn’t mean your options are completely limited, as most banks and loan companies have a way to sell the used car you still owe, a private sale.

How To Sell Your Car When You Still Have A Loan

Used cars sold privately by owner Michael Siluk, Education Images, Universal Images Group, Getty Images

There are many reasons why vehicle owners choose to sell a vehicle privately instead of trading in a vehicle, and they usually have to do with money. While trading in a vehicle at a dealership is less complicated and confusing, the dealership itself has certain fees to consider when buying any used vehicle, so you’ll be offered less money than if you sold it privately. Of course, private sales have some downsides, meaning they aren’t always worth the hassle for some buyers, and in the current market you may see dealer offers that are just as valuable as private sales. Anyway.

Most cars on the market that are several years old will still have a bank lien on them, meaning the bank will hold title until the vehicle is paid off. This doesn’t mean you can’t sell your vehicle privately, it just means there are some hurdles to jump through, which isn’t always a bad thing if you can. To sell cars at a reasonable price. Remember that your bank will not give you the right to sell the vehicle without paying it in full, so the sale price of your vehicle must be at least the balance of the car loan – unless you want to pay it off. Out of your pocket to remove the vehicle. The best option is to contact the bank that holds the consignment of your vehicle and discuss the sale options with them, as they may suggest that you accompany the buyer to the bank office to complete the transaction.

There are many things to consider when selling a vehicle privately, especially if the vehicle is still in lien. In any event, neither you nor the buyer can obtain title to the vehicle during a private sale until the loan is paid off. It is not reasonable or desirable for the buyer to pay for the vehicle before ownership is given because it can take several days for the person in possession to release ownership and you cannot allow someone to take your car without the title transfer being completed. Each car loan and bank may have slightly different protocols for this process, so the only way to know the correct course of action is to contact your bank or mortgage directly before listing the car for sale. When buying a new vehicle, there are many factors to consider. Everything from what you want to sell or trade in your old car to what type or model you want can be a big decision, especially when the average driver has owned a vehicle for eight years. For something you spend a lot of time on, finding a vehicle that fits your needs is important.

Can You Trade In A Vehicle Under Repo Status?

While some people know exactly what they want in a new vehicle, down to the year, make and model, others are unsure. Even more confusing, some vehicle owners still owe money on their last car. You may be wondering, can I trade in my car if I still have money?

The short answer is yes! If you’re ready to buy a new or used car, but still have a car loan on your property, don’t worry. You need to take a few simple steps to better understand your options.

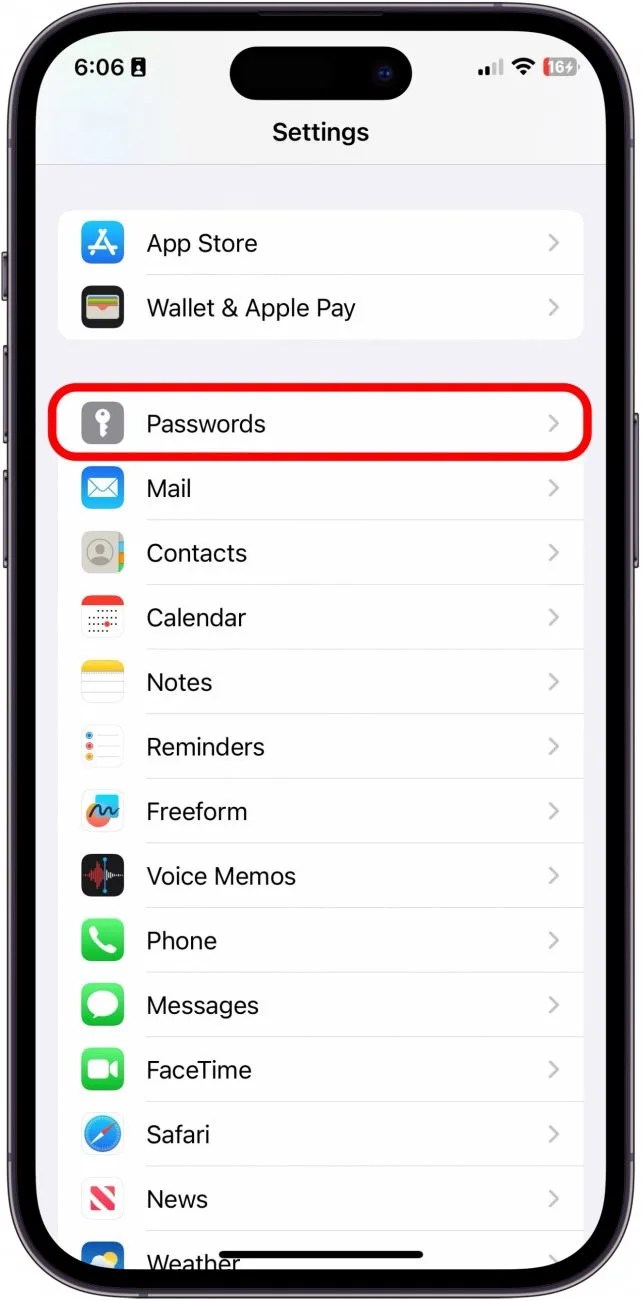

First, check with your bank to see if you still owe money on your vehicle. This will help you when you know the value of your vehicle and the difference. You can then check the Edmunds trade-in page on the Hometown Chilicothe website to find out what your vehicle is worth. This will help you determine your purchasing power and then we can help you find the perfect car!

Whether you have a loan on your car or not, trading in your car is easy when you work with Hometown Auto in Chillicothe OH.. You can apply for financing, get pre-approved and use our payment calculator right on our website! We know that car shopping and buying something new can be difficult. We pride ourselves on providing you with the smoothest and most seamless experience.

What Happens If You Trade In A Financed Car?

Trading in a vehicle that still has cash requires a few more steps. When making the final decision to trade in a car, knowing how much you owe on your vehicle, as well as knowing the value of the vehicle, can be important. After all, if you owe more on your vehicle than it should, it may cost more to trade it in.

Because your loan doesn’t just disappear when you trade in your vehicle. It still needs to be paid. If the value of the car is higher than the amount owed, the transaction will eventually cover the balance of the loan and there may be enough left over to put towards your new vehicle. But if this is not true, you may lose money from the business.

Whatever your reason for wanting or wanting to trade in a car, from looking for more room to better fuel efficiency or any other reason, Hometown Chillicothe can help.

Knowing the value of your car can be very important when trading in your vehicle. When you trade in a paid-off vehicle, you can deduct the total cost of the car from your new car purchase. However, when you’re trading in a loaner car, there’s a little extra math to consider about how much you owe on the loan.

Trading In A Car With A Loan: Everything You Need To Know

Make sure you call your people first

Trade a car that you still owe on, how to trade a car you still owe money on, trade in car still owe money, can you trade in car you still owe money on, can i trade in my car if i still owe, how does a trade in work when you still owe, trade in my car but i still owe money, trade in car you still owe money on, trade in a car i still owe on, still owe money on car trade in, trade in car but still owe money, trade in car you still owe