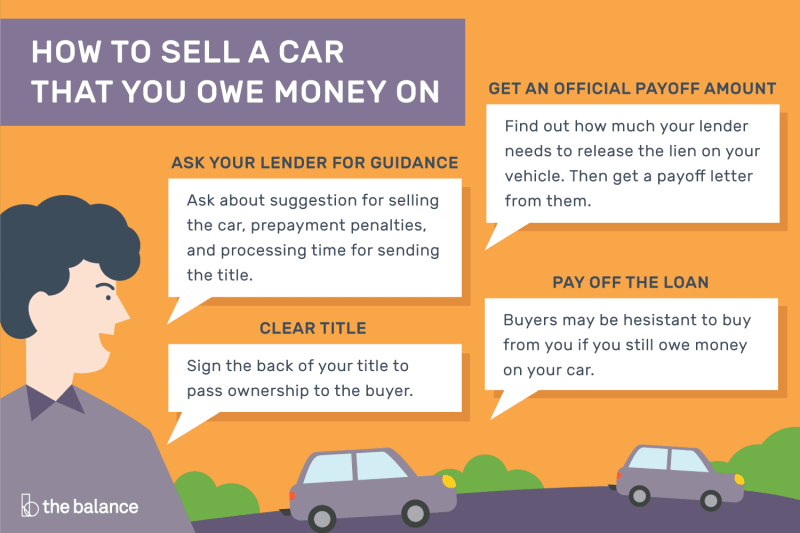

Trade A Car That You Still Owe On – There are many reasons why you might want to sell your car before you can afford it: the loan payments are too high, the car hasn’t lived up to its test drive, or it simply doesn’t meet your needs anymore. And she

It is possible to sell the car even if you still owe the loan. This adds just one more step to the sales transaction: closing the loan with your lender.

Trade A Car That You Still Owe On

The best course of action depends on what you want to sell the car for and whether you have positive or negative equity in the car. While negative equity (due to more on the car than it’s worth) can be a challenge, recent increases in used car values can help some sellers avoid this scenario.

Can I Trade In My Car If I Still Owe Money On It?

If you’re wondering where to start selling your car and making payments, you can:

The editorial section is your source for automotive news and reviews. In line with our long-standing ethical policies, editors and reviewers do not accept gifts or free rides from car manufacturers. The editorial staff is independent of the advertising, sales and sponsored content departments of .

101,000 Kia Missing and Sport Recalled for Roof Moldings Jan 23, 2024 2024 Mercedes-Benz E-Class Facelift Starts at $63 $450 Jan 23, 2024 Closer to 2025 Chevrolet Equinox: Tough and Ready Jan 24, 2024

News Current Events: How Our Tesla Model Y and Jeep Grand Cherokee 4xe Handled Freezing Temperatures in Chicago Posted by Brian Normel and Damon Bell on January 18, 2024

How To Trade In Your Car

Expert Review of 2024 Acura MDX Type S Quick Spin: Performance Vs. Price By Jennifer Geiger News Editor

Expert Review 2024 Lotus Eletre R Quick Spin: Non-Traditional Lotus By Aaron Bragman Detroit Bureau Chief

Expert Review 2023 Mercedes-AMG SL43 Quick Spin: Prove You Don’t Really Need a V-8 By Aaron Bragman Detroit Bureau Chief There are many reasons why you might be looking to drive a current car, but the car still has sales. A mortgage in can make It means you still have a car loan and you need money on the car, it can be confusing. But what he doesn’t want, you can’t sell private.

When it comes to selling a car, we usually don’t have many options. The easiest thing for most owners who still owe money on cars, where there is a bank lien, is to go to a dealer where more experienced sales associates know exactly what to do. There are pros and cons to this, as well as pros and cons to selling your car privately through social media platforms and online, especially if you have an active loan on the car. But just because you don’t have the title in hand doesn’t mean your options are completely limited, as most banks and lending institutions have ways to allow you to sell a used car that you still owe money for. Private sale.

Kicking The Trade’ Explained, And Why It’s A Bad Idea

Used car sold privately by owner Michael Seluk, Education Images, World Image Collection, Getty Images

There are many reasons why car owners prefer to sell their car privately rather than trading it in, and it usually makes money. Although dealing in a car from a dealer can be less complicated and confusing, the dealer himself has some common fees that they have in common with the buyers of used meat, so you will probably be offered less money than you would from a private seller. man. sale Of course, a private sale has some downsides, that is, it is not always worth the headache of some buyers, and you can actually look in your market for an agency that offers a price that is as much as you would like to receive from a private person. sale anyway.

Most vehicles on the market that are a few years old usually have a bank lien, which allows the bank to retain ownership of the car until the car is paid off. This doesn’t mean that you can’t sell your car privately to someone, it just means that some people are jumping outside the gates in this case, which isn’t always a bad thing if you can sell the car. at an honest price. Remember that you don’t give your bank the right to sell the car without full payment, so the price you sell the car for is at least the remaining amount on your car loan – unless you want to pay out of pocket to avoid it. . The best option is the bank that holds the car and can discuss the sale options with them, so they can suggest that you come to the bank office with the buyer to complete the transaction.

There are many things to consider when selling a private car, especially if that car is still subject to a bank lien. Under no circumstances will you be able to transfer ownership of the vehicle in a private sale until the loan has been paid off by either you or the buyer. It is not reasonable or suggested to the buyer to pay for the vehicle before submitting the title, as it can take several days for the title to be released by the lien holder, and never let anyone pick up your vehicle without a title transfer. is completed Each car loan and bank operate a little differently and may have different protocols for this procedure, so the only way to know the correct steps is to contact the bank or franchisee directly before putting the car up for sale. Get your loan today with Discover Infinity. Apply online and be approved in less than an hour!

Should You Trade Your Car In Before It Is Paid Off?

Are you looking for a loan but don’t know where to start? We do the hard work of finding and connecting you with the right lenders and loan providers. You just choose the best option for your circumstances.

Our excellent relationships with lenders give us an advantage over our competitors. It allows us to provide exceptional value on a wide range of interest loans and other financing options.

It’s not as bad as it used to be. We help you understand interest rates, interest rates, loans and different types of loans. We guide you as you navigate the complex world of finance.

Whether you are looking for a car loan, business finance, personal finance, leisure finance, boat, passenger, jet ski or motorbike finance, we will give you the best loan.

How To Trade In A Car That’s Not Paid Off Indiana

1 Credit car search, compare and choose – just three steps to get the car of your dreams. When you need a loan to pay for a car, whether new or used, we can help you explore your options. Learn more

2 A personal financial plan should be tailored to fit your unique needs. Whether you need to cover a major expense, consolidate debt or renovate your home, you can find a great deal with Infinite Loans. Learn more

3 Jetski Financing Jetski Whether you are a professional or a beginner, getting your new jetski is our priority. We can offer you special financing options for your personal watercraft needs. From budget to luxury we can find it. Learn more

4 He is said to have lived in this street. We can help you find financing options with better prices and competitive terms. Learn more

Thinking About Buying A Car? Here’s What Experts Say You Need To Know

5 Caravan Finance If you need a new caravan or motorhome, we can help you find the perfect motorhome for your next trip. Explore the country in a new or used motorhome. Learn more

At 6 Sports Limits, our dedicated experts can offer financing options for sports vehicles. From motorbikes to boats, jet skis or caravans, find the Infinity search at the best rate. Learn more

7 Commercial financing When your business is ready to expand or perhaps needs new equipment, you need fast and secure financing. Consider taking out a business loan to help you manage your expenses. Learn more

8 Commercial Vehicle Financing If your business needs a new executive car, van or light truck, our team of experts can help you get the new vehicle you need, quickly and affordably. Learn more

Need A New Car, But Still Owe More On Yours Than It’s Worth?

9 Boat financing Whether it’s a small or large jet ski, we can help you find the boat loan you need. From fishing to lodging, we have a variety of options to choose from when it comes to water use. Learn more

10 Motorcycle financing With good terms and prices, you can ride on the open road with your dream trip with a fraction of the stress. Our team will help you regardless of your budget or the motorcycle of your dreams. Learn more

11 Insurance We do not only help you find the right loan; We are also experienced in interpreting policies and coverage. We let you manage your risks through a variety of insurance options, such as disability insurance and loan insurance. Learn more

12 Motor vehicle Loans Unlimited is a car loan broker. We lend you to the right loan

Trading In A Car With A Loan: Everything You Need To Know

Trade in car that i still owe money on, trade in my car but i still owe money, can you trade in a car you still owe on, when to trade in a car you still owe on, trade in car still owe, trade a car that you still owe on, can you trade a car you still owe money on, trade in car you still owe money on, trade in car you still owe, how to trade in a car you still owe on, how to trade your car in you still owe on, can you trade a vehicle that you still owe on