No Insurance Car Accident Not At Fault – Even if you are not at fault for your driving in Michigan, you cannot report a car accident if you are uninsured. Even if you are innocent and the other driver was 100% at fault, you cannot sue for pain and suffering damages, medical bills, lost wages, or vehicle repair costs. But you can still sue for other people’s medical bills and lost wages.

This is the most blatant example of how unfair Michigan’s presumption of innocence law is. This shows how much the law is weighted in favor of powerful auto insurance companies. Michigan imposes some of the harshest and most punitive penalties for uninsured drivers. And while I agree that everyone should drive with coverage, should our public policies be enforced by impunity for drunk drivers and others who kill or seriously injure the innocent? It’s an example of the punishment not fitting the crime, and it’s a testament to the power of the insurance industry lobby that pushed the bill through the Michigan Legislature.

No Insurance Car Accident Not At Fault

It is actually worse for a driver involved in an insured car accident who is not at fault in Michigan. In addition to being barred from prosecuting the at-fault driver, uninsured drivers face civil penalties, possible jail time, and driver’s license suspension.

What Happens If You Cause A Fatal Traffic Accident In Singapore?

Allow the insurance industry to rewrite the insurance code so that reckless drivers and drunk drivers who drive without coverage are exempt from government penalties to avoid accidents that kill, injure or seriously injure people. harm Today in the nation. It only helps auto insurance companies and their downlines. He deliberately targeted poor cities like Detroit with high insecurity and poverty rates. It actually protects the insurance industry at the cost of denying it the right to a jury trial and the constitutional right to wrongdoing by another.

Michigan law does not allow an innocent and injured victim of a car accident who is uninsured and the driver who caused the accident to sue for pain and suffering because he or she did not have adequate coverage. Innocent law. (MCL 500.3135(2)(c)).

If you were in an uninsured car accident and it wasn’t your fault and someone injured you, you may not be able to sue for medical bills and/or lost wages related to the accident if your injuries caused you to return to work. prevent return. .

Generally, the victim is entitled to no-fault personal protection or PIP benefits for medical bills (up to no-fault PIP medical benefit coverage selected in the policy) and lost wages.

No Fault Insurance In Ontario

However, if you are in an uninsured car accident and you were not at fault and the accident injured other people involved, you are not entitled to no-fault benefits. (MCL 500.3113(b)).

This means that if health insurance or Medicare or Medicaid does not provide coverage, the uninsured driver must pay out of pocket for their medical bills and lost wages.

Generally, an accident victim can sue the at-fault driver under Michigan torts for up to $3,000 in vehicle damage repair costs. However, if you were in an insured car accident and were not at fault, you are not eligible to make a small claim. (MCL 500.3135(4)(e))

However, in a car accident where the insured driver did not cause the accident, you may be able to sue for the other person’s medical bills and lost wages.

Got Into A Car Accident But It Wasnt My Fault Just To Clarify, Im More Worried Abt How Much Money Ill Be Able To Recover From Like Mods I Installed And Would

If you are involved in an uninsured car accident and you are not 100% at fault, you can be sued for the money that car insurance companies pay for the other person’s medical bills and lost wages on the basis of no-fault benefits. Pay as you go, including the driver. which caused an accident

In fact, no-fault laws allow auto insurance companies to sue not only for “all benefits awarded,” but also for “costs and expenses and attorney’s fees.” (MCL 500.3177(1)).

Michigan law here disparages injury. It also shows how much MPs actually owe the insurance industry.

Anyone who lives or regularly drives a vehicle in Michigan must maintain a valid no-fault policy for their vehicle issued by an auto insurance company licensed to do business in Michigan and with “individual safety coverage.” “Proper payment of interest” provides. ” (also called PIP benefits), “property protection coverage” and “victim liability coverage” (also called bodily injury liability coverage). (MCL 500.3101(1), (2) and (4) 500.3108(1));

What To Do If An Insurance Company Is Stalling Your Car Accident Settlement

The situation worsens if you are uninsured and are at fault in a car accident. You may experience one or all of the following:

Because you were in an uninsured car accident and were at fault, you have no coverage to cover your liability for the above damages and compensation, which means you must pay out of pocket using your personal assets. , for example. Savings, checking, retirement, college accounts for your children, your home, your vehicles, recreational vehicles and future income. The financial burden of your responsibilities will drive you bankrupt.

For more information, see my blog post “Top 9 Dangers of Driving Without Insurance in Michigan.”

The best thing Michigan drivers can do to protect themselves and their families if they are involved in a car accident (whether they caused the accident or someone else caused the accident) is to make sure That they do not have false coverage. A must for your car.

What Happens If You Have A Car Accident Without Insurance?

If you have been injured in a motor vehicle accident and would like to speak with an experienced attorney, call our toll free number 24/7 at (248) 353-7575 for a free consultation with one of our attorneys. You can get help from an experienced accident lawyer through our contact page or by using the chat function on our website.

Steven Gorstein has been named Michigan Attorney of the Year and consistently voted one of the top 50 attorneys in Michigan (out of over 65,000 attorneys) by Super Lawyers. He is the current chair of the AAJ Distracted Driving Litigation Group, chair of the Bailey Society, chair of the AAJ Truck Litigation Group and TBI Group, as well as past president of the Association of Motor Vehicle Trial Lawyers.

Steve J. Supra Readers Choice Award – Named the best author winner in the insurance category every year since 2018. Steve has obtained the largest auto and truck accident settlements of any attorney or law firm in Michigan.

“Maximum stars for this law firm and especially Mr. Steven Gorstein – Attorney. Very professional and prompt! I also received very helpful information about New Auto Law. I have recommended it to all my friends and neighbors.” – Mira

Must I Repair My Car After An Insurance Claim Accident?

Kicking off the new year with what may be one of our coldest, coldest winters ever… No fault, also known as personal injury coverage, is a type of coverage on your auto insurance that in some states is necessary Covering financial losses related to injury. Every driver uses the personal injury protection coverage they need to pay medical bills and lost wages. The driver responsible for the accident uses their own insurance for the car damages and the innocent driver can get pain and suffering through the at-fault driver’s insurance.

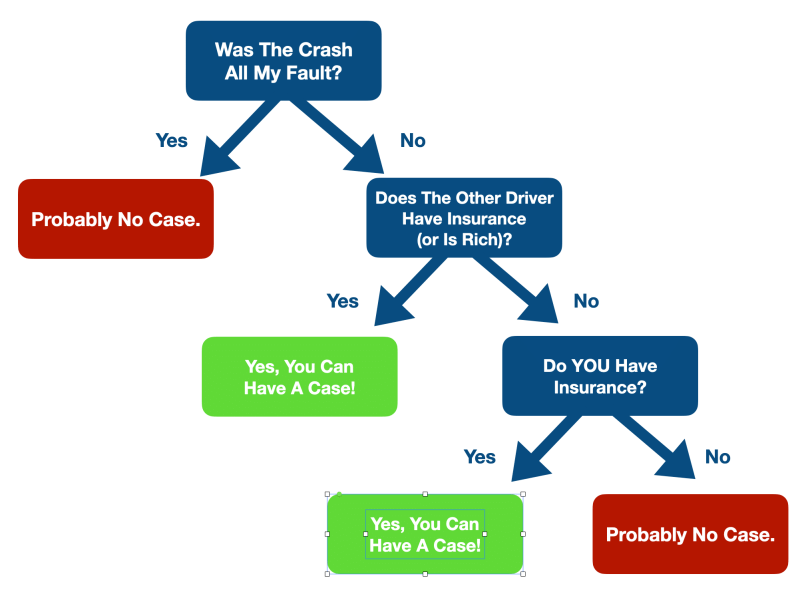

Determining charges after a car accident is the name of the game. If you can prove that the other driver caused the accident, that is, the other driver was at fault, you can compensate them. At least that’s how it works in most states.

But who pays claims in innocent situations? This is where things get a little complicated. Whether you live in a no-fault situation or are involved in an accident, it is important to understand how this affects the liability of all involved. This is where this guide comes in.

No-fault insurance means that in the event of a car accident, each driver is responsible for paying their own medical bills through their own insurance. This requires an additional layer of protection called personal injury protection (PIP), which makes insurance more expensive than in no-fault situations.

If You’re Hit By A Driver With No Insurance, This

States use no-fault insurance to prevent personal injury cases from being tossed out by the courts. If all drivers were required to have PIP, they would be less likely to seek compensation from the other party.

The claim process in a no-fault case is the same as in an at-fault case, except that you won’t be making a claim on the other driver’s insurance:

Personal injury protection insurance generally doesn’t cover damages related to pain and suffering, so you won’t need to include emotional distress or discomfort in your claim.

“Personal injury law firms typically help you recover money for physical injuries, and unfortunately that doesn’t include the body of your car. The reason is the motivation of a personal injury lawyer: the money they Traditional PI lawyers are not motivated to help.

No Fault Car Accident

Car insurance not at fault accident, car insurance at fault accident, car accident with no insurance not at fault, not at fault accident insurance, car accident no insurance not at fault, not at fault accident but no insurance, at fault accident no insurance, car accident not at fault, car accident no insurance not my fault, not at fault accident no insurance, car accident not at fault but no insurance, car accident no insurance not at fault california