Excluded Driver In Accident But Not At Fault – The offers on this page are from advertisers who pay us. It may affect what we write about, but it does not affect what we write about. Here is an explanation of how we make money.

An excluded driver is a member of your household listed on your auto insurance policy that you specifically exclude from coverage. They could be a roommate with a suspended license or your adult child who has received too many speeding tickets.

Excluded Driver In Accident But Not At Fault

Once someone is called an exceptional driver, your auto insurance policy will not cover them if they drive one of the vehicles listed on your policy.

Negotiating A Personal Injury Settlement With Fred Loya Insurance

Here’s what you need to know about excluded drivers, how to add them and how they affect your car insurance coverage.

You can usually lend your car to family, household members and friends, and your car insurance covers them under the concept of permitted use.

Even if a friend borrows your car and causes an accident, as long as they were allowed to use your vehicle, your liability insurance should cover the damage.

As an insured, you can also name others as drivers on your policy who are authorized to drive your insured vehicle and share full coverage. These additional drivers may include the teenage driver, adult children living in your household, or unmarried spouses.

Exclusion For Vehicles With Less Than Four Wheels Invalid In Oregon

You can also add people as unrated drivers, meaning their driving history and other rating factors are not included in your price calculations. You can add someone as an unclassified driver who only uses your car occasionally, such as a student or a deployed military family member. Named drivers, also known as registered drivers, do not have to regularly drive your insured car. Your insurance company will likely only allow drivers on the list who have their own vehicle and/or valid insurance coverage.

Excluded drivers are also listed on your policy – but with the express purpose of excluding them from coverage.

There are many reasons why you may choose to exclude a driver from your car insurance, not the least of which is to save money on your premiums. Other reasons for excluding certain drivers are:

If you have a problem driver at home, one of the best things you can do for your insurance rates is to include them as an excluded driver.

A Break Down Of Your Ca Auto Insurance Policy

If this disabled driver is not included in your policy, your carrier may require you to add them as a licensed or classified driver, especially if they live with you. If they are inexperienced drivers, have a history of at-fault accidents or multiple claims, or have a driving record full of violations, you may find that your premiums are affected. This often happens even if you don’t actually give the person permission to drive your vehicle.

By including them as an excluded driver, both you and your operator reduce your overall level of risk. Your insurance company is no longer liable if they are driving one of your registered vehicles and have an accident. Your insurance premiums no longer take their driving history into account, saving you money.

The most important thing to remember is that once you have excluded a driver from your policy, you cannot allow them to drive your vehicle under any circumstances. This action opens you (and you) to personal liability should they be involved in an accident.

Except in some states, your auto insurance company will not extend coverage to a named driver. This means that all property, bodily or personal injury coverage ends when the excluded driver is behind the wheel and you can sit in the seat for any damages.

What Does No Fault Car Accident Insurance Cover In New York?

The fact that a driver is not included in the insurance does not mean that he does not have his own insurance. In fact, if the person plans to drive and/or own a car, he needs to buy car insurance.

If the person was involved in an accident while driving another vehicle (other than the one covered by the policy), their own coverage must be provided to cover any damages.

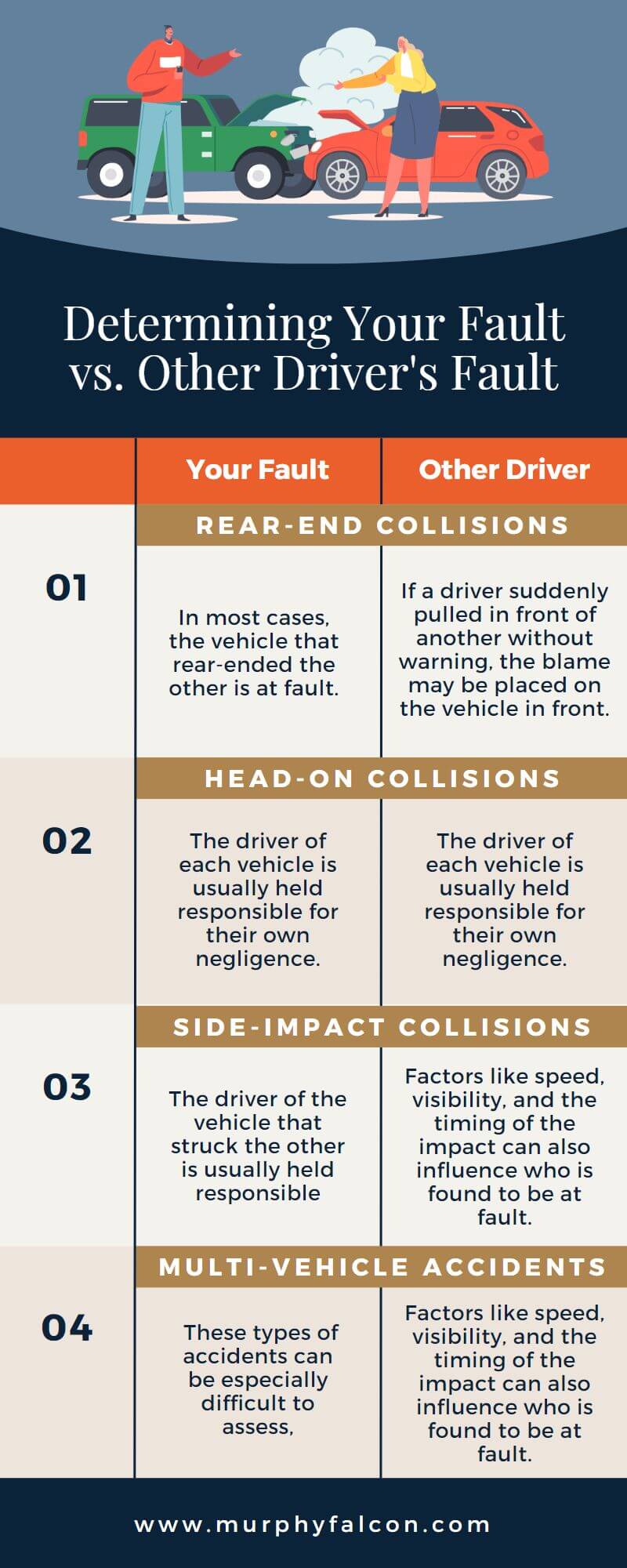

If a disqualified driver is driving your vehicle and gets into an accident, it really depends on the state and individual policy.

If the other driver is found to be at fault in the accident, there is a good chance that their liability policy will cover any damages, even if the driver was not behind the wheel. This will be determined by an insurance adjuster after the accident.

When And How To File A Car Insurance Claim [calculator]

That being said, if you put someone as a disqualified driver and then let them drive your vehicle, there will be consequences. At the very least, you as the policyholder should be required to add that person to your auto insurance policy as a licensed driver. You can also expect your premiums to go up.

Each car insurance company has its own process for naming drivers excluded from insurance. In most cases, you will be asked to sign and submit a driver exclusion form as part of the process.

It is important to note that not all states allow exempt drivers. Some states may offer limited coverage to excluded drivers, even if they are listed in the policy. And in other cases, excluded drivers can only be included after you prove they have the right car insurance.

You should check the specific regulations in your country and also talk to your carrier about your options before proceeding.

Someone Else Was Driving My Car And Got Into An Accident

You must contact your insurance company if you wish to remove the excluded driver. You may want to add them as a covered driver if, for example, they improve their poor driving record. Or remove them from your policy entirely, perhaps because they’ve left your home. Many or all of the products shown here are from our partners who compensate us. This affects which product we write about and where and how the product is displayed on the page. However, this does not affect our assessment. We have our own opinions. Here is a list of our partners and here is how we make money.

Excluding a driver from your car insurance may sound like removing someone from the policy. But exclusion and termination mean different things to an insurance company.

You can choose to remove a driver if a household member moves out and no longer drives your car regularly.

You must call your insurer to remove the driver from your policy. Some vendors may allow you to remove drivers online or through their app.

Ny Car Accident Lawyer

Remember that a driver who does not live with you will still be covered to drive your car from time to time upon approval. All authorized drivers in the household must be listed on the policy, unless they are excluded.

If you remove someone who is still living with you, coverage for that person while you drive your car is uncertain.

You can exclude a driver if you or your insurance company do not want anyone in the household to be covered by the insurance.

To remove a driver from your policy, contact your insurance company and complete a driver non-removal form.

When Someone Else Gets In An Accident In Your Car

Generally, an accident will not be covered if the excluded driver is using your car. For example, you may not be liable for an accident if a suspended driver takes the car without permission, but you must prove that the driver stole the vehicle.

Follow Kayda Norman Go to my settings page to see all the authors you follow.

Kaida Norman is an authority on car insurance. She previously worked in communications at the Walt Disney Company and as a web producer and writer for several health and fitness publications, including Health magazine. His work has been featured in the New York Times, Washington Post, and USA Today. Read more

What is comprehensive car insurance Read more by Drew Gula Affordable car insurance by Ben Moore, Ryan Brady Read more

Important Commercial Auto Insurance Exclusions

Sign up and we’ll send you geeky articles about the money that matters most to you and other ways to help you get more out of your money. Written by Mandy Sleight Mandy SleightArrow True Contributor, Personal Finance Mandy Sleight has been a licensed insurance agent since 2005. He has three years of experience writing for insurance sites such as , MoneyGeek and The Simple Dollar. Mundy writes about auto, homeowners, renters, life insurance, disability and supplemental insurance products. Twitter Connect with Mandy Sleight on Twitter LinkedIn Connect with Mandy Sleight on LinkedIn Connect with Mandy Sleight by Email

Edited by Angelica Lecht By Angelica Lecht Right Arrow Editor, Credit Cards Angelica Lecht is an editor at Par and CreditCards.com. She has over a decade of experience as a writer and editor, with a particular emphasis on personal finance content for more than half of her career. Angelica Licht

B, we strive to help you make smart financial decisions. To help readers understand how insurance affects their finances, we turned to licensed insurance professionals with a combined 47 years in the auto, home and life industries.

Excluded driver not at fault, car accident no insurance not at fault, not at fault accident, not at fault accident no insurance, accident not my fault, at fault car accident, excluded driver at fault, lawyer for car accident not at fault, not at fault accident lawyer, not at fault accident without insurance, at fault accident lawyer, at fault accident attorney