Cheap Car Insurance With At Fault Accident – Partner Content: This content was created, researched and written by a Dow Jones business partner, regardless of copyright. Links in this article may earn us a commission. Learn more

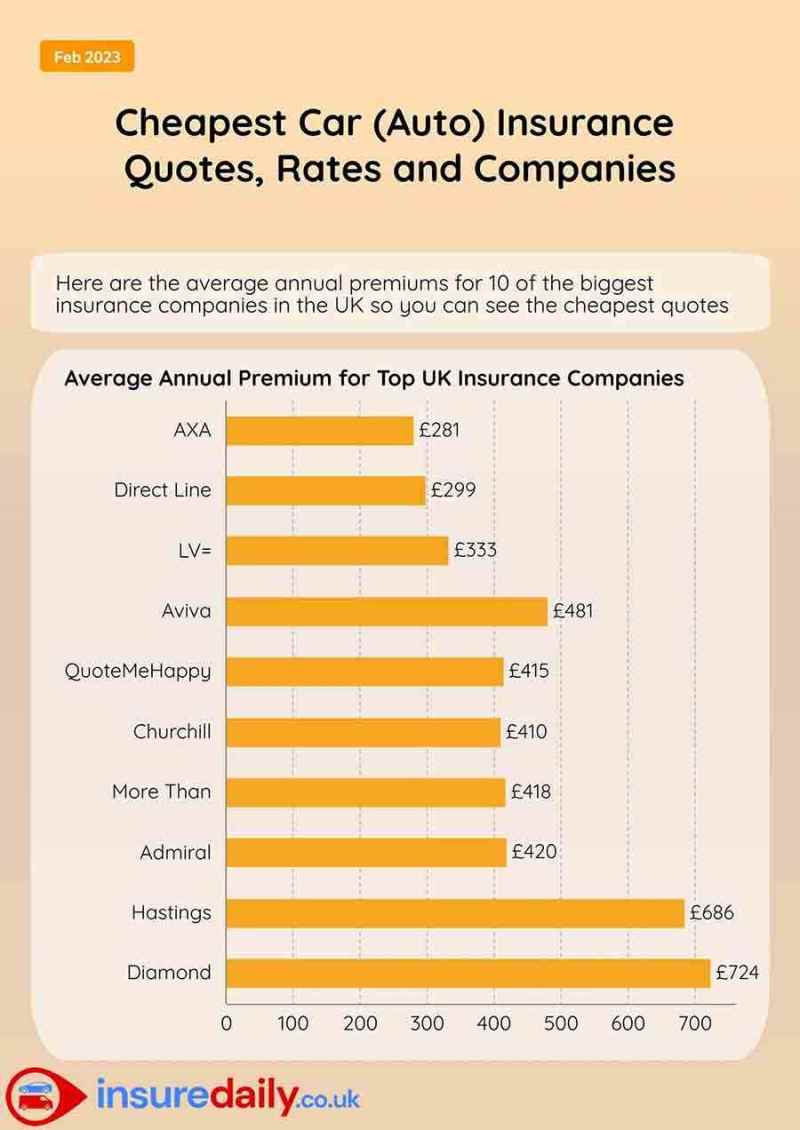

The cheapest car insurance costs an average of $28 per month. USAA, Auto Owners and Erie offer the highest average prices

Cheap Car Insurance With At Fault Accident

Written by: Daniel Robinson Written by: Daniel Robinson Author Daniel is a group writer and has written for several automotive news outlets and marketing companies in the US. USA, UK and Australia, specializing in car financing and maintenance. The Daniel Group is the authority on auto insurance, loans, warranty options, auto service and more. The author

Best Cheap Car Insurance Companies Of 2023

Editor: Rashan Michner, Editor: Rashan Michner Managing Editor Rashan Michner is a group editor with 10 years of experience in personal finance and insurance. Chief Editor

A liability insurance policy is the cheapest coverage you can buy. However, it generally provides the minimum coverage required by state law. In this article, the Guides team will show you the top providers that offer the cheapest car insurance on average. We also look at the average cost of liability insurance by state and how comprehensive liability coverage compares with comprehensive insurance.

When looking for cheap auto insurance, we recommend taking advantage of the best insurance companies in the industry. Help compare car insurance quotes to find the best rate possible.

Cheap Car Insurance Loans Cheap Car Insurance Loans Vs. How much comprehensive car insurance do I need? How much does new used car insurance cost? Used car insurance

Do I Need To Get A Lawyer For A Car Accident That Was My Fault?

The Guide team is committed to providing reliable information to help you make the best decisions about your auto insurance. Because consumers trust us to provide accurate information, we have created a comprehensive ranking system to maintain the ranking of the best car insurance companies. We collect data on several car insurance providers to rate companies based on several factors. After 800 hours of research, the final result is a rating for each provider, with insurers with the highest points at the top of the list.

If you want cheaper auto insurance, you may want to consider purchasing liability-only coverage that meets your state’s minimum auto insurance requirements.

We research the cheapest auto insurance companies and states with the cheapest liability insurance. The estimates in the following sections are based on a 35-year-old married driver with good credit and a clean driving record.

According to our research, National Insurance offers the cheapest coverage at an average of $30 per month or $356 per year. The next cheapest liability insurance coverage typically comes from homeowners insurance, which charges an average of $30 per month or $358 per year.

How Much Can I Claim? Traffic Accident Claims Simulator Launched To Help Motorists Settle Out Of Court

Iowa is the state with the cheapest car insurance, according to our statistics. The average cost of a liability-only policy in the Hawkeye State is typically $23 per month or $274 per year. Florida has the most expensive liability insurance with premiums of $115 per month or $1,385 per year.

Auto liability insurance covers property damage and personal injury to another party if you are found to be at fault in a car accident. If the other party is injured, your insurance provider will pay for the other party’s vehicle repairs or medical expenses.

Each state sets the minimum coverage required by law, which usually includes some form of liability insurance. The only exceptions are Virginia and New Hampshire, as neither state requires drivers to have auto insurance.

The amount of liability insurance coverage is represented by three numbers. Each number represents the following load types:

Does An Accident Go On Your Driving Record?

An example of a liability insurance policy might be 25/50/25, meaning you have $25,000 in bodily injury coverage per person, $50,000 in accidental bodily injury coverage, and $25,000 in liability damages. Any accident

Car liability insurance does not cover the costs associated with damage to the vehicle or your injury. Collision insurance covers the cost of repairing your car. Your medical bills (MedPay) or personal injury protection (PIP insurance) cover your medical bills.

If you are found not at fault for the accident, neither you nor the insurance company is liable for property damage or injury to another person.

If you have a car loan or lease, you may need to maintain comprehensive car insurance. With this in mind, if you own your vehicle, you should consider liability-only car insurance.

Cheapest Car Insurance For Drivers With Accidents

You should also remember that details and connections are the best deals when your car is new. As your vehicle ages, the average amount you can get for a claim goes down. When your car is 10-12 years old and its total value has dropped below $10,000, it’s hard to call it good car insurance.

A comprehensive coverage policy usually includes coverage limits required by the state, including coverage and comprehensive coverage. Some comprehensive plans may include uninsured motorist (UM) coverage as some states require it.

Insured-only car insurance has the cheapest rates in the industry, especially on comprehensive coverage. This is because liability coverage does not provide much protection. See how the average annual rates for the two types of coverage compare:

As you can see, it is not uncommon for auto insurance to pay only 60% less than a full coverage plan. Again, it’s all about getting what you pay for, as a comprehensive car insurance policy provides more protection than liability coverage.

Best Car Insurance Companies Of February 2024

When calculating auto insurance quotes, insurance companies look at several factors to estimate how much you will pay.

To get cheaper car insurance, you can work to improve your premiums and avoid abuse. We also recommend that you ask your provider about available auto insurance discounts. Some providers offer discounts to good drivers or policyholders who bundle their car insurance with homeowners or renters insurance. Discounts are also common for qualified students and members of various professional associations.

Cheap auto insurance is the minimum level of coverage your state requires to legally drive. Each state sets its own rules, so liability costs only vary from state to state.

If you are planning to purchase a liability-only auto insurance policy, we recommend that you check out the policies offered by USAA and Erie Insurance.

Cheapest Car Insurance Quotes In Santa Fe, Nm For 2024

By researching the top insurance companies in the country, we found that USAA consistently offers some of the lowest car insurance rates available. In addition to having the cheapest coverage on average, USAA offers several coverage options, such as accident waivers and traditional auto insurance.

USAA also maintains an A++ rating from AM Best, which reflects its financial strength and credibility as a company. Remember that USAA coverage is only available to active duty military, veterans and their immediate family members.

If you live in Washington, D.C. or any of the 12 Arie states, you may be the right choice for cheap auto insurance. The company is known for its affordable prices, charging an average of 28% less for both coverage and total coverage than the national average.

In addition to cheap coverage, Erie offers a comprehensive list of coverage options and many optional extras. The provider has good financial strength, indicating that the claim is likely to be paid, according to AM Best.

How Much Does Insurance Increase After An Accident?

In most states, you need at least $50,000 in bodily injury coverage ($25,000 per person) and $25,000 in property damage coverage per accident. Some states also require uninsured motorist coverage with personal injury coverage or medical coverage.

What you can pay for auto insurance is usually your state’s minimum coverage rate, which varies based on factors such as your vehicle and location. According to our research, National Insurance has the cheapest car insurance at an average of $30 per month or $356 per year. Iowa has the lowest average liability insurance premium in the United States at $23 per month or $274 per year.

General liability insurance is the cheapest car insurance because it only covers bodily injury and property damage to another party when you are involved in an accident. It does not cover damage to the vehicle or expenses related to your injury.

Driving without insurance is illegal in all states except Virginia and New Hampshire. Penalties for driving without insurance vary by location.

Better Safe Than Sorry: A Guide To Buying Car Insurance

National Business is generally the cheapest company for minimum liability auto insurance, averaging $30 per month or $356 per year for drivers who are married with good credit and a clean driving record. Owner’s insurance lags behind USAA, averaging $30 per month or $358 per year for liability coverage.

Because users trust us to provide accurate information, we have created a comprehensive rating system

No insurance at fault accident, at fault accident, car accident without insurance at fault, at fault accident attorney, at fault accident without insurance, at fault car accident with insurance, not at fault accident, not at fault accident without insurance, at fault car accident lawyer, car accident not at fault, car accident no insurance not at fault, at fault car accident