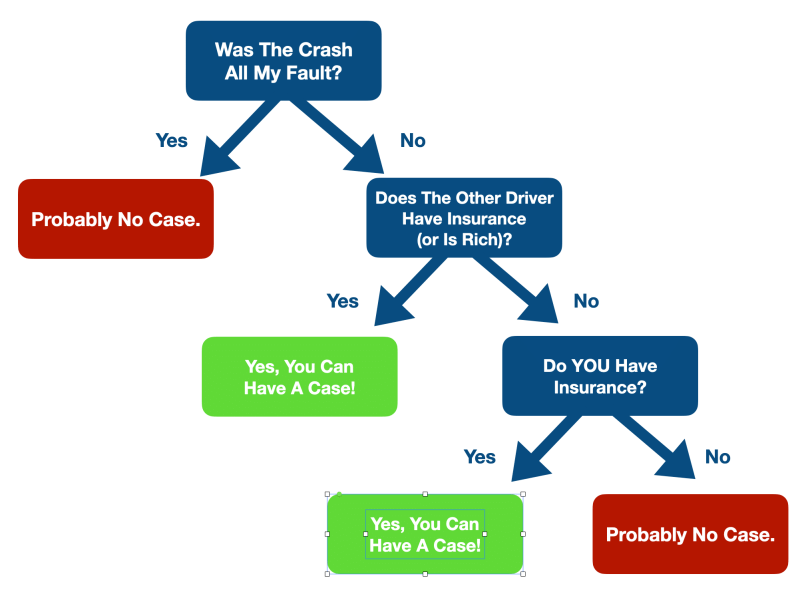

Car Accident No Insurance Not My Fault – If you were not at fault while driving in Michigan, but you do not have insurance, you cannot file a car accident lawsuit in Michigan. Even if you are innocent and the other driver is 100% at fault, you may not be able to claim compensation for pain and suffering, medical bills, lost wages, or vehicle damage. But you can still claim other people’s medical bills and wages

This is an incredible example of how unfair Michigan’s no-fault auto law is This shows how much the law weighs in favor of powerful car insurance companies Michigan has some harsh penalties for uninsured drivers I agree that everyone should have insurance, does it really serve our public policy to indemnify drunk drivers and those who cause serious injury and death to innocent people? It’s an example of a punishment that doesn’t fit the crime, and a testament to the power of the insurance industry lobby that pushed this law through the Michigan legislature.

Car Accident No Insurance Not My Fault

In Michigan, an unsafe and at-fault driver gets worse in a car accident In addition to suing the guilty or negligent driver, an uninsured driver may face civil penalties, jail time, and driver’s license suspension.

Who Pays The Deductible In A Not A Fault Accident In Ontario

Allow the insurance industry to rewrite the law so that reckless drivers and drunk drivers who kill, disable, or seriously injure people killed, maimed, or seriously injured by uninsured driving are more punitive than any state in the country today. . This only helps the car insurance company and their bottom line It deliberately targeted poor cities like Detroit with high levels of uninsured and high poverty. It takes away people’s right to a jury trial and protects the insurance industry at the expense of constitutional remedies for the wrongdoing of others.

Michigan law does not allow uninsured, innocent, injured car accident victims to sue the driver of their vehicle for injuries or damages because the person driving their vehicle did not have adequate insurance under the law. No fault law (MCL 500.3135(2)(c))

If you are involved in an uninsured, no-fault car accident and someone is injured, you cannot sue for medical bills and/or lost wages if the accident prevents you from returning to work. .

Generally, the victim is entitled to receive personal protection or PIP benefits for medical bills (even medical coverage selected in the benefits policy) and lost wages.

What Determines Your Car Insurance Premium?

However, if you are in a car accident with no insurance and are not at fault and other people are injured in the accident, you will not receive any no-fault benefits. (MCL 500.3113(b))

This means that an uninsured driver will have to pay the pavement for medical bills and lost wages if they do not have health insurance or Medicare or Medicaid coverage.

Generally, the victim of an accident can claim up to $3,000 from the driver to repair the damage to the vehicle. However, if you are involved in an uninsured and no-fault car accident, you may not be able to file a small damages claim. (MCL 500.3135(4)(e))

However, if an uninsured driver does not cause the accident, this means that you can claim for the other person’s medical bills and wages.

Instances When Another Driver’s Mistakes Will Cost You

If you’re in a car accident without insurance and you’re not 100 percent at fault, auto insurers can sue other people who caused the accident, including the driver, for medical bills and lost wages. Accident. caused damage Destruction

In fact, the No-Fault Act allows auto insurance companies to sue not only for “all benefits provided,” but also for “damage repair costs, expenses and attorney fees.” (MCL 500.3177(1))

This is Michigan’s Contempt of Injury Act It also shows how committed lawyers are to the insurance industry.

Individuals who reside or regularly drive in Michigan must have a valid auto insurance policy issued by an auto insurance company authorized to do business in Michigan that pays for private safety coverage benefits. (also known as PIP benefits), “property protection insurance” and “residual liability insurance” (also known as personal injury liability insurance). (MCL 500.3101(1), (2) and (4); 500.3108(1))

Understanding Non Fault Claims

If you are at fault in an uninsured car accident, the situation will be even worse You may experience one or more of the following effects

If you are involved in a car accident without insurance and are at fault, this means that you will not be covered for the above damages and compensation, meaning you will have to pay out of pocket for your personal belongings. Savings, checking, retirement, college accounts, your children, your home, your vehicle, recreational vehicle and future income. The burden of your financial obligations can lead to bankruptcy

For more information, read my blog post on 9 Dangers of Driving Without Insurance in Michigan.

The best thing Michigan drivers can do to protect themselves and their families in a car accident is to make sure they have a valid No Claims Certificate, whether they caused the accident or someone else. – Need damage insurance for their vehicle

I’ve Been In A Car Accident, Do I Have To Claim On My Insurance?

If you have been injured in a car accident and would like to speak with an experienced attorney, call our 24/7 hotline at (248) 353-7575 for a free consultation with one of our attorneys. You can visit our contact page or use the chat feature on our website to get help from an experienced accident attorney.

Steven Gurstein is a respected Michigan lawyer and consistently named one of the top 50 Michigan lawyers (out of over 65,000 lawyers) by Super Lawyers. He is the current president of the AAJ District Driving Litigation Group, past president of the Bailey Society, past president of the AAJ Truck Litigation and TB Group, and president of the Motor Vehicle Litigation Bar Association.

Steve is the 2018 annual JD Supra Reader’s Choice Award Winner – Insurance Writer. Steve is a Michigan attorney and law firm handling the largest auto and truck accident settlements.

“One of the biggest stars of this law firm, especially Mr. Steven Gurstein – Lawyer. Very professional and fast! I also got very useful information about new car law. I have recommended him to all my friends and neighbors.” – Mira

There Is A Loophole In The System’: Car Accident Victim Finds Himself Unable To Claim Insurance

As we head into the new year and face colder, colder weather… “Expert Validated” means that our Financial Review Board has carefully reviewed the article for accuracy and clarity. Our review board consists of a panel of dedicated financial experts to ensure our content is always objective and balanced.

Posted by: Casey Goff Posted by: Casey Goff Arrow Posted by: Right Personal Finance Contributor Casey Goff is a personal finance and insurance writer with over seven years of experience in personal and commercial insurance. He writes for The Simple Dollar, Next Advisor, Varo Money, Coverage, Best Credit Cards, and more. He covers a wide range of policy types including high-end insurance such as wrap insurance and E-O and specializes in auto, home and life insurance. Connect with Casey Goff on LinkedIn Connect with Casey Goff by Email Email Casey Goff

Edited by Jessa Claes Jessa Claes is the Right Editor of Around, Insurance Jessa Claes is the Insurance Editor for Auto, Home and Life Insurance. He has over six years of experience writing, editing and leading a team of content creators dedicated to helping others build a healthy financial future. His work has been published in numerous insurance, personal finance and investment publications, including Jerry’s, Bigger Pocket, 401(a) Expert and BP Wealth. Connect with LinkedIn LinkedIn Jessa Claes

Steve Ellis, CPCU, AIC, MBA Steve Ellis, CPCU, AIC, MBAArrow Wright Assistant Vice President and Claims Field Manager Steve Ellis, CPCU, AIC, MBA is a 30-year veteran of the insurance industry. His expertise spans training, operations, quality improvement, auditing, compliance, claims technology, data and analytics. About our Board of Supervisors Steve Ellis, CPCU, AIC, MBA

Best Car Insurance Companies In Singapore For 2024

, we strive to help you make smart financial decisions We employ licensed insurance professionals with 47 years of experience in the auto, home, and life insurance industries to help readers understand how insurance affects their finances. We strictly follow

. Our content is sponsored by our licensor, Coverage.com, LLC (NPN: 19966249). See our for more information

Founded in 1976, the company has a long history of helping people make smart financial decisions

Car accident not my fault, no-fault car accident settlement, car insurance accident not my fault, car accident not my fault no insurance, accident not my fault insurance, car accident no insurance not at fault, car accident my fault insurance, injured in car accident not my fault, car accident my fault no insurance, not at fault accident no insurance, no insurance accident my fault, no insurance accident not my fault