Can You Sell Your House If You Still Have Mortgage – If you fall into mortgage default and have to sell your home to pay off the loan. There are many options to consider. Our team of real estate professionals asked the question “Can You Sell Your Home If You Have Arrears?” This guide combines and answers to other frequently asked questions about home payments, selling your property and getting your mortgage.

According to figures published by UK Finance, 75,670 homeowners owed 2.5% or more of their outstanding mortgage in the first quarter of 2022, down 5% on the same period in 2021. Generally, last year there was a degree of delay. That’s relatively low because millions have taken advantage of “mortgage holidays” offered by lenders to help homeowners weather the loss of income during the pandemic.

Can You Sell Your House If You Still Have Mortgage

However, this number is likely to increase in the second half of the year as the mortgage holiday ends and the cost of living rises. According to research by the Office for National Statistics (ONS), 30% of UK homeowners cannot afford their housing costs and 3% are behind on their mortgage repayments. If inflation continues to rise as predicted. Bad debt arrears are likely to become more common.

Can You Sell Your Property When Separating In Edmonton?

At the Home Buyers Bureau; We understand that falling into foreclosure is sometimes completely unavoidable, and we’re here to help homeowners get back on their feet. An unexpected job layoff where you can’t make your monthly mortgage payments; Whether it’s a sudden illness that left you unable to work or a recent separation that left you out of pocket, there are many ways to think about it.

Most homeowners want to avoid foreclosure; They decide to sell their homes to pay off debt and free up some money to start anew. If you are facing financial difficulties; This can help you move into a more affordable and manageable property and get you back on track financially.

If you’re struggling to pay your mortgage, selling your property can free up capital and leave you with plenty of cash that can be used to pay off the arrears and buy or rent a cheaper property. a while

If you fall behind on your payments and your home is ready to be repossessed, your home will be sold at auction by your mortgage lender.

What If You Sell Your Home But Don’t Have A New Place To Live?

Taking action to avoid repossession once you’re in mortgage debt can lead to better results for the homeowner. If your mortgagee repossesses the property and proceeds to sell it, you may not be able to get a high sale price to cover your outstanding balance. In this case, you fill in the blanks.

By selling your mortgage to a reputable lender like the Home Buyers Bureau, you can get a better price for your property and avoid putting your name on the record, which could affect your future credit applications. . You can pay off your mortgage with income and save what’s left to invest in a new home.

At the Home Buyers Bureau; We can help you sell your property as per your requirement and within 7 days. We give you instant access to the cash you need to get out of debt and pay directly into your bank account to start elsewhere.

Regardless of whether the loan is outstanding or not, the mortgage must be repaid when the house is sold, without taking out a loan on the new property. Many mortgage lenders allow borrowers to ‘port’ an existing mortgage to another.

Reasons To Sell Your Home Now 2022

If you are in arrears or in business, don’t fall into arrears. Moving from one property to another that you can’t afford is not an option. In this case, you must pay off your mortgage when you sell your home. No need to worry about paying off the mortgage after selling your home. Your attorney will pay the balance of the sale proceeds. All that is left will be paid to you minus any real estate agent and solicitor or conveyancing fees.

If you are in negative equity – the value of the home is less than the remaining mortgage balance – the sale price does not cover the remaining mortgage balance. You must continue to pay the lender until the loan is paid off. given

The Financial Conduct Authority (FCA) has suspended recovery during the pandemic. Expires 1st April 2021. Since then, the number of recoveries has increased due to clearance of goods accumulated during the moratorium.

If your financial difficulties are temporary – you’ll need some time to recover when you’re getting 80% of your paycheck – consider asking about a payment schedule to help you get back on track.

How To Sell Your House Today… And Buy Another One In This Market.

To avoid foreclosure and collect your dues; You should contact your lender once you miss a payment. Don’t wait to get in touch when you miss a mortgage payment.

If you miss a payment “under normal circumstances” (ie before COVID-19), you are “in arrears” and at risk of recovery. Paying off late can seem like a disaster, but in most cases, it is. It’s not the end of the world. Many mortgage lenders offer the homeowner a period of time called a “grace period” after payment. This period is usually 10 to 15 days. Landlord payments are not reported late.

However, if your home payment is late or missed beyond the initial grace period. A late fee will be charged. Depending on your mortgage agreement, this can be between 5% and 10% of the monthly repayments. It might not seem like a big increase, but late fees and missed payments quickly became unmanageable. If you do not agree to a new repayment plan or cannot resume regular payments. The borrower can initiate court proceedings to repossess the property.

If you think payment will be delayed; You should contact your lender as soon as possible to find out more about how long you can receive.

Survey: 74% Of Homeowners Are Hesitant To Sell Now

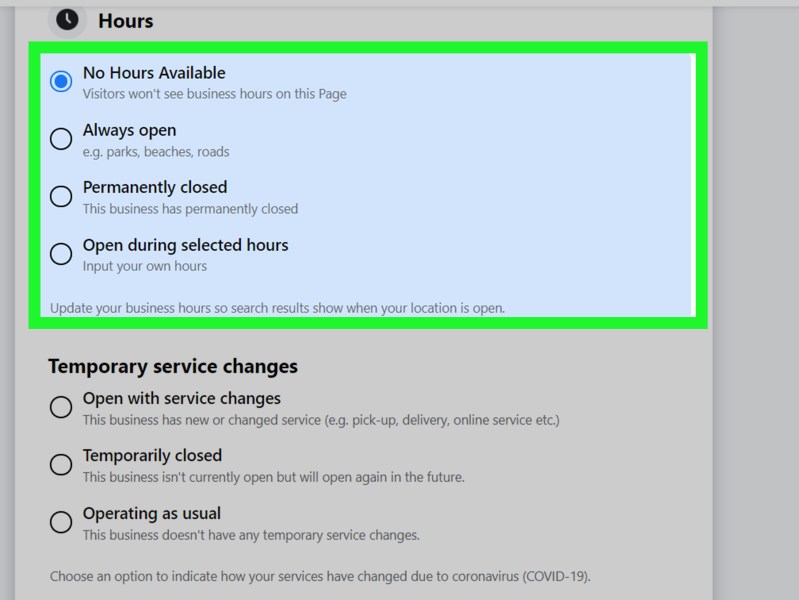

Your mortgage company is regulated by the Financial Conduct Authority (FCA) and must adhere to the FCA’s Code of Conduct for Mortgage Companies (MCOB), which ensures borrowers are treated fairly and equitably. Your lender should work out an alternative repayment plan until you start making regular payments. Rehabilitation should only be sought as a last resort.

You can find a temporary solution that will reduce your income and increase your income until your financial situation stabilizes. For example, a borrower may agree to accept lower payments for a fixed term or agree to switch to another type of loan with lower monthly payments. You can rent a room or supplement your income enough to cover your shortfall until regular payments resume. There are many organizations that offer free debt advice and can help, such as Charity Change.

If your financial difficulties are not temporary and you cannot resume regular mortgage payments. It is best to sell the home as soon as possible to avoid going into mortgage debt.

If you are under financial stress and unable to keep up with your mortgage repayments; You may consider selling your property back to the bank before foreclosure. However, this is not always the best option.

Five Common Home Pricing Mistakes And How To Avoid Them

Because your mortgage loan is a secured financial transaction between you and the bank, the bank can legally repossess your property and sell it on its payment obligations, leaving you with little to no funds. If the bank wants to sell your property quickly and it is below the average price. You still need to pay the dues. After all, it’s the mortgage that your bank is interested in, not your property. The mortgage will remain in effect until it is paid in full.

Banks may also add additional charges that increase your loan. legal fees; Sales commissions and other costs may apply and we do not cover all of these additional costs. Unless the bank sells your house and sells it quickly, which is rare. You are responsible for mortgage payments while you are in the real estate market.

Bank may also allow you to declare “Voluntary Recovery”.

Can you sell your house if you still have a mortgage, can you still sell your house if it in foreclosure, can you sell your house if you have a mortgage, can you sell your house while still paying mortgage, can i sell my house if i still have a mortgage, can you sell your house if you have a reverse mortgage, how do you sell your house if you still have a mortgage, can you sell a house if you have a mortgage, how to sell your house if you still have a mortgage, can i sell my home if i still have a mortgage, can you sell house if you still owe mortgage, can you sell your house if you still have mortgage