Can You Sell A Car You Still Owe On – There are many reasons why you may decide to sell your car before it is paid off: the loan payments are too high, the car has not been road tested, or it simply does not meet your needs more. This

The ability to sell your car even if you still owe on the loan. This just adds a step to the sales transaction: closing the loan with the lender.

Can You Sell A Car You Still Owe On

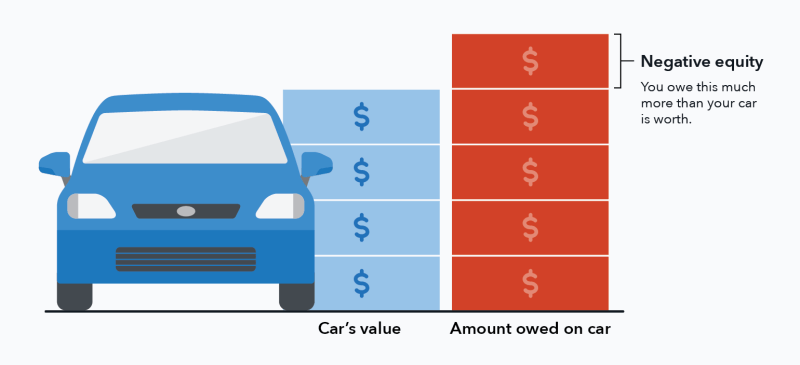

The best approach will depend on how you plan to sell the car and whether you have positive or negative equity in the vehicle. While negative equity (owing more to a vehicle loan than it’s worth) can be a challenge, the recent increase in used car values can help some dealers avoid this situation. .

What Is A Branded Title? What It Means, Types, And Risks

If you’re wondering where to start selling your car and getting paid, here’s what to do:

The Editorial Department is your source for automotive news and reviews. In accordance with the company’s longstanding ethics policy, editors and reviewers do not accept gifts or free trips from car manufacturers. The editorial department is independent from the advertising, sales and sponsored content departments.

2025 Chevrolet Equinox with macho styling, more conventional technology Jan 23, 2024 2024 Acura MDX S Type Quick Release: Jan 23, 2024 Price performance: 2024 Acura ZDX EV $65K Price Jan 22, 2024

Polestar 4 2025 news imminent: new SUV coupe (only) ahead By: Mike Hanley January 11, 2024

Can I Sell My Car If I Haven’t Paid It Off?

2024 Acura MDX Type S Convertible Expert Review: Performance for the Price by Jennifer Geiger, News Editor

Fast-spinning Lotus Eletre R 2024 Expert Review: Not Your Traditional Lotus By Aaron Bragman, Detroit Office Chief

2023 Mercedes-AMG SL43 Quick Conversion Expert Review: Proof You Don’t Need a V-8 By Aaron Bragman Detroit Bureau Chief There are many reasons why you might want to consider trading in a car or selling the car you still own. on money. You may need to increase or decrease your monthly payment.

Whatever your reasons for wanting to sell a car that still has a loan on it, the good news is that it’s easier than you think!

What To Do If You Own More Than Car’s Worth

Read below to learn how you can easily sell or trade your vehicle, even if you still owe money on your car loan.

One thing we’ve been seeing a lot lately is car owners looking to get out of their current loan. The monthly payments are too high for their current budget, the interest rate is too high, or maybe the vehicle just doesn’t meet their needs anymore. Whatever the reason, some Ohio car owners sometimes feel stuck in a loan they no longer want.

If you try to sell your car privately now, you cannot do so until the loan is paid off. If the car sells for more than the loan amount, that’s not a problem. However, the problem is when the debt is higher than the value of the car.

This is called negative equity or being “underpowered” on the loan. The remaining funds needed to be raised to complete the sale. This is where an Ohio car dealership like Evans Dealer Group can help.

Can You Sell A Car If It Isn’t Paid Off?

Usually, when you sell a vehicle, the seller pays off the remaining balance and uses the remaining value of the vehicle as a down payment. You will also receive the difference in cash. But when you trade in a vehicle with negative equity, the seller won’t be able to pay off the full balance of the loan. But don’t worry, Ohio drivers have several options in this situation.

A popular option for our customers who need to get out of an expensive car loan is to transfer the remaining loan balance to a new vehicle. Let’s say you have $2,000 more than your vehicle is worth. Your transaction will leave that $2,000, which will be added to your new car loan.

Although this will make the new loan more expensive, it will be spread over the life of the loan. If the new or used car you’re buying is cheaper than the one you’re getting rid of, or if the interest rate is lower, your monthly payments will go down.

But what if you don’t want to trade? As mentioned above, you can try to sell on the private market. But we all know that comes with time, with bad deals and the uncertainty of handing over your keys to a stranger.

How To Buy A Used Car That Hasn’t Been Paid Off

Not all car owners in Dayton, Ohio realize that they can easily sell their car to a dealer. Many dealers offer used cars worth more than the market value of the KBB.

This means that even if you owe a little more than what KBB says your car is worth, a trip to Evans Dealership Group can get your loan paid off and let you walk away with a check in hand.

If you have a vehicle that you are thinking of selling, get a quote from Evans Dealer Group and get the best for your vehicle. You can sell your car if you still have money on it. However, before you can transfer the title to the new owner of the car, you must pay the debt. The process varies depending on whether you are selling your car to a dealer or a private buyer.

You are looking for a shiny new car, but you still have money on your car. Can you sell your car if you’re still making payments on it?

Can I Sell A Car With Outstanding Finance?

Yes, you can sell your car if you still owe money on it, but you must pay off the debt before you can transfer ownership of the car to the new owner.

You’re ready to buy a new car and get rid of your current one. However, one thing stands in the way: you still owe money on a car loan. Next depends on who buys your car.

If you are trading in a new car or selling it to a dealer, the dealer handles the car loan repayment process. When you pay for a new car (or take out a new loan), the dealer pays off the balance on the previous loan, usually by sending the money to bank or credit union. If you sell your car and the dealer values it for more than what you’re worth, you can pocket the difference or use the extra money to buy a new car.

Once the car is sold at the dealer and the loan is paid off, the lender releases the lien on your car. Under a lien, the lender holds title to your car and is its legal owner until the loan is repaid. This allows the lender to sell your car if you default on the loan.

How To Sell Your Car When You Still Have A Loan

The situation is a bit more difficult if your contract is worth less than you own. In this case, the dealer usually “rolls” the amount you owe on your current loan toward your new car loan. This basically pays off the old loan.

If you sell your car to a private buyer and you still have money, the situation will be even more complicated. You cannot transfer property to the customer until the loan is paid off.

In a private transaction, you may want to close the sale at the current holder’s location (such as the bank or credit union where you got your car loan). In this way, you can use the money from the buyer to pay off the loan and transfer ownership of the car to the buyer immediately.

Another option for the buyer is to pay back the loan. However, many lenders do not allow this. And if the lender approves it, the buyer must meet the lender’s criteria for the new loan, including a minimum credit score and debt-to-income ratio ( DTI).

How Voluntary Repossession Impacts Your Credit

Whichever route you choose to sell your car, be sure to ask your lender about prepayment penalties, title transfer requirements, and other details.

When selling your car and still have cash, consider whether you have positive or negative equity. Positive equity means you owe less than the car is worth, measured by its current market value, while negative equity means you owe more than the car is worth.

For example, if you have a $15,000 car loan, but your trade-in value is $17,500, you will be left with $2,500 in positive equity (the trade-in value subtracted from the balance of the loan).

If you sell a car with positive equity to a dealer, the dealer usually takes care of paying off the loan for you. If you sell a car with positive equity to a private buyer, you use the sale proceeds to pay off the loan and then pocket the difference.

How To Trade In A Car: Everything You Need To Know

Now, if you have a $17,500 car loan and your trade-in value is $15,000, you will be left with a negative equity of $2,500 (the loan balance minus the trade-in value). This is also called a foreclosure.

With positive equity on your side,

Can you sell a car you still owe on, how to sell a car you still owe on, can you sell a car you still owe money on, can i sell a car i still owe money on, can you sell a car that you still owe on, trading in a car you still owe on, still owe money on car can i sell, can you sell a house you still owe on, trade in car you still owe, how to sell a car you still owe money on, car totaled still owe on loan, can you trade in your car if you still owe